A sustained and strong economic growth since the beginning of last decade helped Bangladesh qualify for lower-middle income status in 2015 and to remain on the course to graduate from the UN's Least Developed Countries (LDCs) group in 2026. The impetus to this economic growth emerged mainly from liberalisation of trade and financial sector, favourable demographic factors, financial inclusion, and macroeconomic stability. Alongside, a stride in labour-intensive manufacturing exports, led by readymade garment (RMG), also contributed to achieving remarkable economic growth, creating employment, and reducing poverty.

Registering 10.25 per cent average annual growth rate over the last two decades, Bangladesh's export earnings stood at US$ 46.36 billion in 2019 which was 15.32 per cent of Gross Domestic Product (GDP).

However, Covid-19 driven economic slowdown inflicted damage on global export demand. According to World Bank data, world export declined by 8.98 per cent in 2020. The pandemic, which also hit hard Bangladesh economy, slashed real GDP growth to 3.51 per cent in FY20 from 8.15 per cent in FY19 and reduced export sharply by 16.23 per cent to 12.18 per cent of GDP. This quick slump in export in Bangladesh than global average suggests a presence of some country specific factors, in addition to the pandemic driven global economic slowdown that played a crucial role in determining export performance during this period.

The 8th five year plan (8FYP) envisages Bangladesh to be an upper-middle income country by 2031 and underscores the importance of sustained strong export growth for achieving this target. However, graduation from LDC group poses some challenges to Bangladesh economy, particularly to the export sector. LDC graduation would relinquish a number of trade preferences and privileges that Bangladesh is currently enjoying in its major export destinations, creating a risk of losing a significant amount of export in the post-graduation period. Therefore, Bangladesh would require devising appropriate policy to overcome these challenges in the post-graduation period. Given this backdrop, this note describes key features of current exports and identifies the potential source of export vulnerability to help appropriate policy formulation for sustainable export growth.

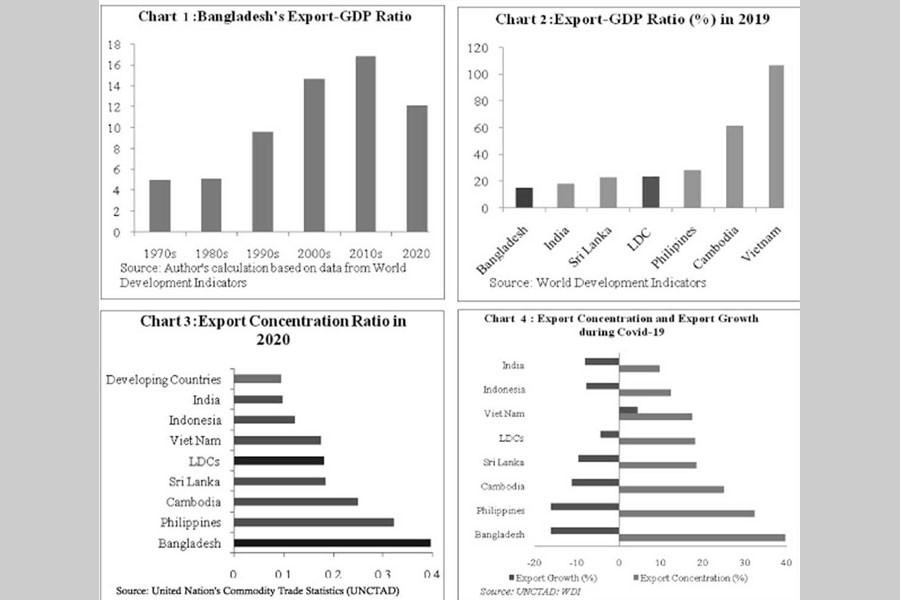

A BRIEF OVERVIEW OF EXPORT SECTOR: In the early period of its independence in 1971, Bangladesh followed a highly-restricted trade regime and an inward-looking import substitution industrialisation strategy characterised by high tariff and non-tariff barriers and an overvalued exchange rate regime to protect the domestic manufacturing industries from foreign competition. These policies were biased against exports, and export earnings therefore remained relatively low in this period. In 1970s, total export earning was at around 5 per cent of GDP on average (Chart 1), and the export basket was highly dominated by agricultural goods. Raw jute and jute goods composed around 87 per cent of merchandise exports during this period. Although exports in the 1980s remained broadly stagnant at around 5.15 per cent of GDP on average, the share of jute and jute goods in total merchandise exports declined to 51 per cent by FY86 on account of falling demand for and price of jute in the global market with the emergence of alternatives to jute.

Since the early 1990s, the industrialisation policy of Bangladesh started shifting toward export-led industrialisation strategy, favoured mainly by foreign trade and financial sector liberalisation, exchange rates rationalisation, and private investment promotion policies. With these policy supports, Bangladesh's exports continued shifting toward a labour-intensive manufacturing goods and export earnings started rising at a faster pace. The export-GDP ratio picked up to 20.16 per cent in 2012, led by a stride in labour-intensive readymade garment (RMG) export. Liberalisation of trade, reforms in the financial sector, availability of cheap labour, and a shift in global trade regime, among others, contributed to RMG exports of Bangladesh quickly. The Multi-Fiber Agreement (MFA), relaxation of rules of origin and duty-free and quota-free access under the Generalised System of Preference (GSP) facility in the European Union (EU) markets helped boost Bangladesh's RMG export. However, the export-GDP ratio started declining and came down to 12.18 per cent in 2020 during the Covid pandemic.

Although export-GDP ratio has been growing over time, it is still lower than the peer countries. The size of Bangladesh's export at 15.32 per cent of GDP in 2019 was far lower than the LDCs average of 23.38 per cent (Chart 2). In 2019, among the SARRC countries, the export-GDP ratios of India (18.43 per cent) and Sri-Lanka (23.13 per cent) were higher than Bangladesh's. Among the closest rival for RMG exports, Vietnam and Cambodia's export-GDP ratios were 106.80 per cent and 61.09 per cent, respectively in 2019, remarkably higher than that of Bangladesh.

PATTERN AND STRUCTURE OF EXPORT OF BANGLADESH: Historically, Bangladesh has been heavily dependent on a narrow range of products for most of its export earnings. In the early 1980s, jute and jute goods accounted for around 70 per cent of its total merchandise exports. With the gradual transformation of the economy into labour-intensive manufacturing from agrarian base, the share of RMG products in total export started rising since the mid-1980s. RMG products have constituted more than four-fifth of total export earnings since 2015. In FY21, RMG constituted 81 per cent of total export of Bangladesh of which 44 per cent of total export came from knitwear and 37 per cent came from woven garments. Although Bangladesh exports covered many other goods (total 98 categories of products at two digit HS code), their share in total export earnings remained relatively small. The third largest export item was jute and jute goods (3.0 per cent) followed by home textiles (2.9 per cent), agricultural product (2.7 per cent), and leather and leather product (2.4 per cent).

An extraordinary large share of RMG in total export has made Bangladesh's export basket highly concentrated compared to that of other developing and low-income countries, implying lack of comparative advantage in most of its products. According to the export concentration index data, published in the United Nation's Conference on Trade and Develop-ment (UNCTAD)'s Commodity Trade Statistics, the concentration ratio of Bangladesh's export was 0.40 in 2020, which was more than double compared to 0.18 of LDCs and more than four times than developing country average (0.09). [The export concentration index shows to which degree exports of a country is concentrated on a few products rather than being distributed in a more homogeneous manner among several products.] The export baskets of Bangladesh's peer countries and main competitors in RMG export markets, such as India, Vietnam, Cambodia, and Indonesia, were much less concentrated than Bangladesh (see Chart 3).

Although Bangladesh sells goods to nearly 200 countries, its exports are highly concentrated in few destinations. In FY21, around 70 per cent of the country's total export earnings came from three markers, such as the European Union (EU), the United States (US), and UK. Facilitated by the duty-free and quota-free access, the EU became the largest destination of Bangladeshi exports, mainly RMG, accounting for around 45 per cent (excluding UK) of total export in the past few years. However, the US is the single largest export destination that accounted for around 15 per cent of Bangladesh's exports.

DISADVANTAGES OF EXPORT CONCENTRATION : As export of an economy largely depends on external demand, the vulnerability in exports and thereby economic growth of a country may emerge from economic shocks originating in its export destinations. The impact of this external shock largely depends on the degree of concentration of the country's export portfolio. Concentrated export basket and export market amplifies the vulnerability of an economy to external shocks. Therefore, to strengthen resilience to external shocks and to achieve a higher sustainable rate of economic growth, an open economy should pursue policies to diversify exports. Diversification helps countries to hedge against adverse terms of trade shocks by stabilising export earnings and domestic output.

The concern about vulnerability to external shocks with concentrated export structure comes true for Bangladesh during the Covid-19 pandemic. The outbreak of pandemic caused a notable global economic downturn, and global export declined considerably due to weak external demand. During the pandemic, world export shrunk by 8.98 per cent in 2020, while Bangladesh's export earnings witnessed a sharper decline of 16.23 per cent. Bangladesh's export loss was much higher than the average export loss of LDCs (4.32 per cent) and some other comparable countries (Chart 4) during the pandemic.

Chart 4 shows a gross positive association between export concentration and export loss for the comparable countries, except Vietnam, during Covid-19 pandemic. Export concentration for India was lower than other comparable countries followed by Indonesia, Vietnam, Sri Lanka, Cambodia, Philippine, and Bangla-desh. Bangladesh and Philippine experienced a larger decline in export with higher concentrated export basket. With a relatively less concentrated export basket, India registered a smaller decline in export, while Vietnam registered a positive export growth.

CONCLUSION: Bangladesh has emerged as a high growth country in 2010s which helped the country to qualify for lower-middle income status in 2015 and to fulfil the prerequisites for LDC graduation involving income per capita, human assets, and economic and environmental factors. The country will gain the status of a developing country in 2026. The export sector led by RMG has played a crucial role in achieving this remarkable progress by creating employment and reducing poverty. Over the last two decades, registering 10.25 per cent average annual growth rate, export earnings of the country stood at US$ 46.36 billion in 2019 which was 15.32 per cent of GDP. However, the outbreak of Covid pandemic caused a decline in export of Bangladesh by 16.23 per cent to 12.18 per cent of GDP in 2020, while world export shrunk by 8.98 per cent. The sharper fall of Bangladesh's export implies a role of country-specific factors, in addition to the pandemic-driven global economic slowdown.

This note finds that highly concentrated export basket and export market prompted the negative impact of the pandemic on Bangladesh's export. This result of highly concentrated export basket has an implication for appropriate policy formulation, which is essential to address the challenges during the post-LDC graduation period.

Syeda Ishrat Jahan is Deputy General Manager, Chief Economist's Unit, Bangladesh Bank.