The current issue of the Banks in Switzerland, published on June 28, 2018, may bring some relief to the country's policymakers. The annual publication of the central bank of Switzerland is a "commented collection of statistical source material on the Swiss banking sector… based mainly on statistical surveys of banks carried out by the Swiss National Bank".

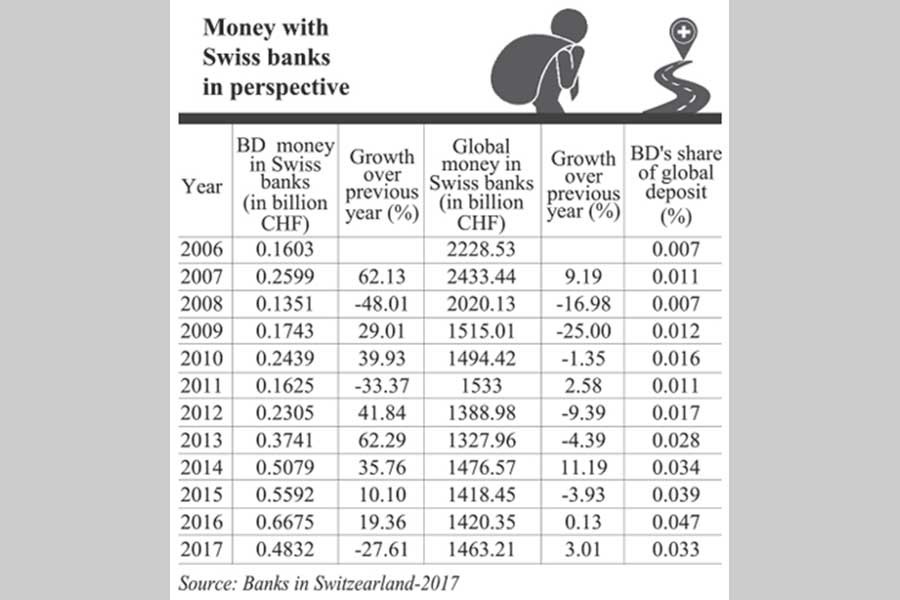

The Banks in Switzerland 2017 records that Bangladesh-linked funds in different banks of the Swiss tax haven declined significantly in 2017.

Earlier, media reports alleged stashing of funds from the country to the Swiss tax haven. This sparked hot debate in the country. Four years back, in 2014, lawmakers in parliament expressed concern over the surge of capital flight from the country to different destinations including Switzerland. In response, Prime Minister Sheikh Hasina announced that the government would take necessary initiatives to recover the money kept in the Swiss banks.

But in 2017 the finance minister came up with a different explanation on the matter. He said that money deposited in Swiss banks is mostly related to trade-related transactions. He also brushed aside the media report on allegation of stashing money in Swiss banks. The finance minister based his statement on the central bank's analysis of bilateral trade data and trade-related transactions. He also argued that the actual amount of stashed money was very negligible and that the media inflated the figure.

This year, finance minister or any other policy maker is yet to make any comment on the decline of Bangladesh-linked funds in the Swiss banks.

According to the Banks in Switzerland 2017, such funds declined by 27 per cent in 2017 to CHF 483.25 (Taka 40.91 billion) from CHF 661.96 million (Taka 56.26 billion) in 2016. But the bilateral trade, according to Swiss official sources, posted 14 per cent growth and reached at CHF 676.80 million in 2017 which was CHF 591.50 million in 2016. The trade balance tilted in favour of Bangladesh meaning the country is exporting more than importing from the Alpine nation.

Thus the argument of the finance minister that the amount of deposit of Bangladesh money in Swiss bank is related to the volume of bilateral trade transactions does not appear to hold good.

The finance minister or any policymaker has not yet come forward with an explanation why the deposit of Bangladesh money in Swiss banks declined in 2017 compared to 2016 when the volume of trade was higher during the year.

In fact, the attempt to establish a correlation between Bangladesh money in Swiss banks and bilateral trade transactions has already raised a number of questions. When the debate sparked in 2014, Bangladesh Bank said that it would communicate with the Swiss central bank on this matter and also try to sign a cooperation agreement. Little has been done in the last four years in this regard. It is not understandable why the central bank took three years to detect the link between bilateral trade transaction and deposits in Swiss banks. Moreover, a portion of the Bangladesh-related money in Swiss banks is legal deposit of Non Resident Bangladeshis (NRBs) and nothing to do with bilateral trade transaction.

Statistics furnished by the Banks of Switzerland (CHB) do not include the money that any Bangladesh-linked clients of Swiss banks might have parked in the name of shadow entities or shell companies. This is a common practice in the tax havens and offshore jurisdictions to make the capital flight smoother.

One reason for the decline of Bangladeshi money in Swiss banks may be that a portion of the funds is transferred to other tax havens like Dubai, Singapore or Seychelles. Many Indians actually did it for the last couple of years when the Indian government reached a deal with the Swiss government to share information on Indian depositors in Swiss banks. They transferred their financial assets to Dubai or Hong Kong by opening shell companies with the help of tax lawyers and accountants. Once these companies get official registrations in those countries, they become legal entities. Now these legal entities are lawfully allowed to open their accounts in the Swiss banks and park their funds.

The main problem regarding the Bangladesh-linked money in Swiss bank is that the policy makers are in denial of such transfer of money. Interestingly, this year Indian government has also come up with a similar kind of denial approach. Indian media reported that Indian black money in Swiss banks increased by 50 per cent in 2017 reversing the past three years' trend of decline. But some Indian ministers argued that all the money in the Swiss banks were not black or illegally transferred.

No matter how small the amount of Bangladeshi money in the Swiss banks is, it is important to make a serious effort to determine the real extent of black money. Denial or undermining the scope of capital flight will not bring any positive outcome in the long run.