Published :

Updated :

Imagine a simple number that can show your attitude towards debt. More importantly, it is an un-erasable mark that reflects bad behaviour in the past and compels good behaviour in the future with a lifelong financial identity. While it is not common in our country, in the developed economies, it is the most important decision making tool for lenders. Besides, an employer can use this number for making decisions about their prospective employee.

The concept is Credit Scoring. Introduction of credit scoring method for measuring prospective customer's risk will allow lenders to differentiate loan terms or service for clients based on risk segmentation. It will open up possibilities to increase operational efficiency in disbursements and collections. A credit score is a number that helps lenders decide whether or not to approve a loan, and what types of loans to offer.

The success of credit scoring system depends on active management, regular monitoring and periodic adjustment, which largely depends on informed, trained and equipped bank personnel. It allows lenders to be nimble at decision-making. A high credit score deems you worthy of credit and a low credit score suggests you are not.

As such, in the developed economies, your credit score is an important part of your overall financial health and having a good credit score can help you save money. In fact, your credit score may be a deciding factor for a personal loan, a car loan, or a home loan.

Credit Score is a three-digit numbering system for the scoring which ranges from 300 to 900, the higher the score, better it is for the borrower. It is a simple number that lenders can use to evaluate how likely you are to repay. Instead of spending 90 minutes on each loan applicant, scores take much less effort to generate.

Originally, credit approval decision was made through a purely judgmental approach by merely analysing the application form details of the borrower. The decision-maker focused on the 5C's of a customer:

- Character: measures the borrower's character and integrity i.e., reputation, honesty, etc.

- Capital: measures the difference between borrower's assets and liabilities

- Capacity: measures the borrower's ability to comply with obligations i.e., job status, income, etc.

- Collateral: measures the collateral to use in the case of default

- Condition: measures the borrower's circumstances i.e., market condition, competitive pressure, etc.

It is worth mentioning, that this expert-based judgmental attitude towards credit scoring is still widely used by emerging market banks where there is limited information and data unavailability. The credit scoring model weighs key characteristics obtained from the application form to identify an aggregated or a range of score of risky borrowers. These weights are determined according to the relationship between the values of characteristics and the default behaviour.

The profile of the borrower, his educational background, number of years in service, number of dependents, income, savings, other assets, property he chooses to buy and many more, are factors that the lenders look into.

Nowadays, many employers in developing countries have started perusing credit scores of potential employees, especially the financial services companies. As mentioned earlier, many consider the credit report as reflection of the character and try to read the person through that.

Traditionally, the FICO (Fair Isaac Corporation) score is the most popular score used for important loans like home and auto loans. However, this is gradually changing. The FICO credit score looks at how much debt you have, how you have repaid in the past, and more. Scores fall anywhere between 300 and 850 and are made up of the following components:

- 35 per cent of Payment History - have you missed payments or defaulted on loans?

- 30 per cent of Amounts Owed - how much do you owe?

- 15 per cent of Length of Credit - is borrowing new to you?

- 10 per cent of New Credit - have you applied for numerous loans in the recent past?

- 10 per cent on Type of Credit - do you have a healthy mix of different types of debt?

FICO Scores are calculated from many different pieces of credit data in your credit report. This data is grouped into five categories as mentioned above and consider both positive and negative information from credit report. Late payments will lower scores, but establishing or re-establishing a good track record of making payments on time will raise the score.

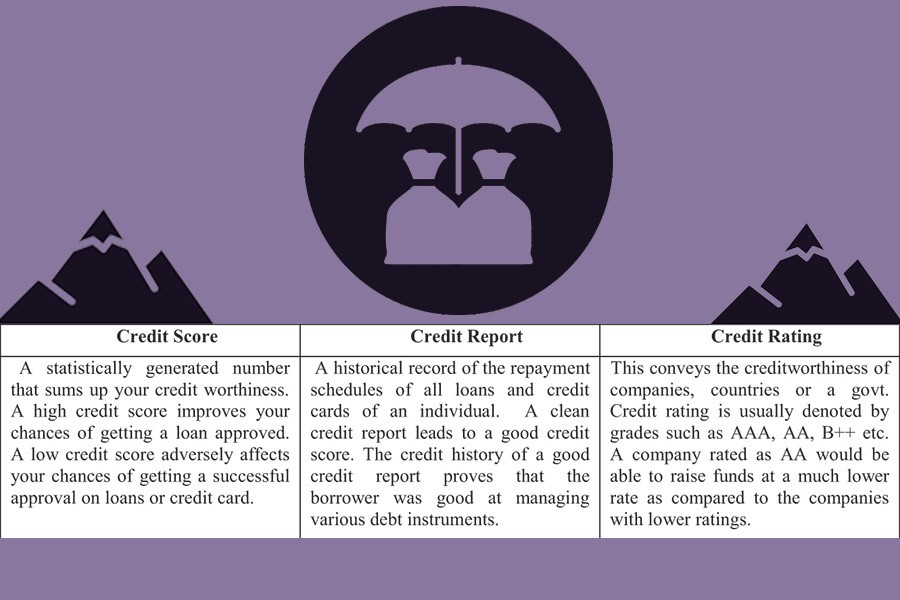

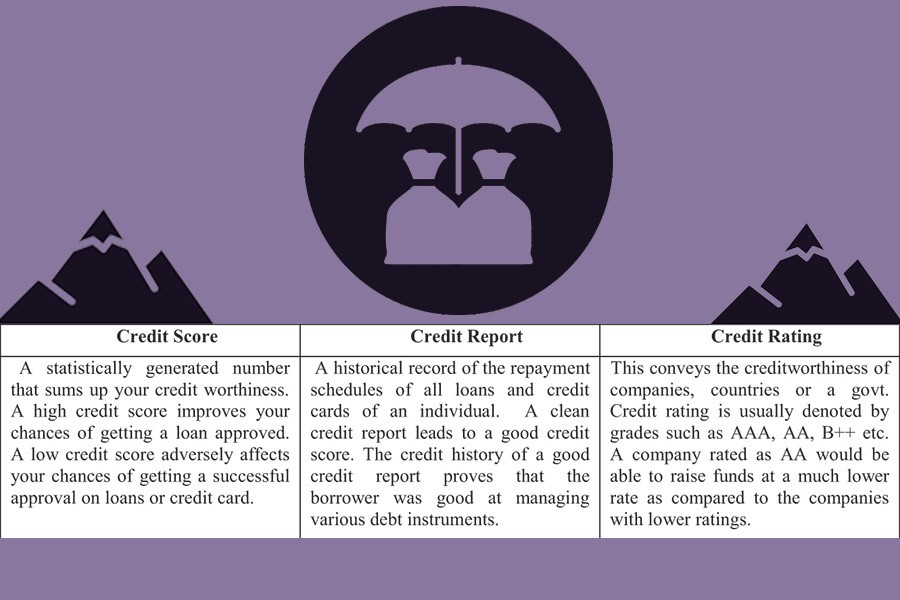

Due to the interchangeable use of these closely related terms, there is often confusion between the terms credit score, credit report and credit rating. The three terms can be differentiated in the following manner:

Before credit scoring, lenders assessed prospective customers based on factors such as payment history, word-of-mouth and home visits. Character-based decision-making was part of the process. Those reputation-based, qualitative assessments have evolved into quantitative ones based on deep data analysis now known as credit scores.

Eventually, lenders developed a scoring system, but it was clunky and still dependent on human emotion and judgment. It is incredibly difficult for people to be truly impartial when judging another person, so something had to be done to create a truly impartial system.

In the 1950s, Bill Fair, an engineer, and Earl Isaac, a mathematician, created an automated scoring system that was initially a flop. They continued to refine it and continued to use technology and computers to build what became the FICO score. Later, they sold their credit scoring idea to banks and retailers in the United States and around the world.

The Fair Credit Reporting Act, passed in 1970, created a regulated system regarding what information would be collected, what could be reported and for how long, and how consumers could obtain copies of their credit reports. Data became more standardised and led to enhanced accuracy.

The modern recapitulation of the FICO score, based on credit files from the three credit bureaus - Equifax, Experian and Trans Union was introduced in 1989. Initially, the credit scores were developed in the 1950s, but became much more prevalent in the 1970s till 1990s.

In India, there are four credit information companies licensed by Reserve Bank of India. The Credit Information Bureau (India) Limited (CIBIL) started functioning from January 2001. Subsequently in 2010, Experian, Equifax and Highmark were given licenses by RBI to operate as credit information companies in the country.

The central bank of China cleared eight companies, including affiliates of social-networking giant Tencent, Ping An Group and Alibaba, to establish consumer credit rating operations. Another company named Sesame Credit can rate both consumers and small businesses.

In Canada, credit scores are considered as the backbone of the financial industry. Recently, credit scoring has reached beyond lending as the data collected by credit bureaus is now being used to make decisions on potential renters, job applicants and even romantic partners.

Banks in developed nations as US, UK and Europe have been using credit scoring techniques with higher success rate. On the other hand, the lack of proper data and reliable information about the credit or monetary history of bank clients in the developing countries can make credit scoring difficult to deal with. Some developing countries are already using credit scoring system that were designed by developed nations and many of them are working to create their own credit scoring systems. However, credit scoring has not been practiced effectively in small financial areas like mortgages, credit cards or personal loans.

It is expected that integration of automated credit scoring system in Bangladesh can benefit the financial sector as well as economy. Moreover, in our country small and medium enterprises (SMEs) are thought to be an important source of innovation and employment because of their flexibility in responding to new market opportunities and their potential for growth. Many developing countries have already commenced to practice automated credit scoring as a tool for their economic development.

In practice, the processing of any loan takes a basic period of time as the credit appraiser waits for reports from various other agencies before issuing the loan approval letter. Having a credit report in hand does not enhance the processing time. Most lenders do the credit check once more.

The major advantage of utilising automated loan application and scorecards is the reduction of time for assessing new applications. Applications can be screened and scored in real time, which is imperative in today's highly competitive credit market. Another key advantage of using this system lies in its simplicity; the scorecard is extremely easy to examine, understand, analyse and monitor. Analysts can perform these functions without having in-depth knowledge of statistics or programming, making the scorecard an effective instrument for managing credit risk. Finally, the development process for these scorecards is remarkably transparent and can easily meet any regulatory requirement.

Automated loan application system & auto generated credit scoring are necessary as the technological upheavals are changing consumer perception and behaviour, which further impact demand for financial services. We have been closely observing the changing consumer behaviour and we are embracing new technologies for that reason. We know that digitalisation will be the dominant form of interaction between banks and customers.

Lack of capability to assess credit risk is seen as a key hindrance for banks to expand lending to small businesses and consumers. Most banks' lending in Bangladesh is collateralised, but smaller borrowers typically lack sufficient collateral, they need accurate credit assessment without any collateral.

The good news is that change is coming and it's coming fast. Innovative new lending startups will take the place, because the emergence of new data sources has allowed us to evaluate creditworthiness in ways that were not previously possible.

As more and more transactions and interactions occur online and on our mobile devices, consumers are openly generating thousands of data points that provide insight into their lives. This data is often easy for consumers to share, offers a more comprehensive profile of their creditworthiness and can be evaluated almost instantly by underwriting algorithms.

By introducing online loan application and score based lending system, we can unlock the full promise of Fintech (financial technology) to ensure a smooth transition towards tomorrow's financial system.

Md. Abdul Kader is an Assistant Vice President & Head of Retail Credit of Southeast Bank Limited.

kader_brc@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.