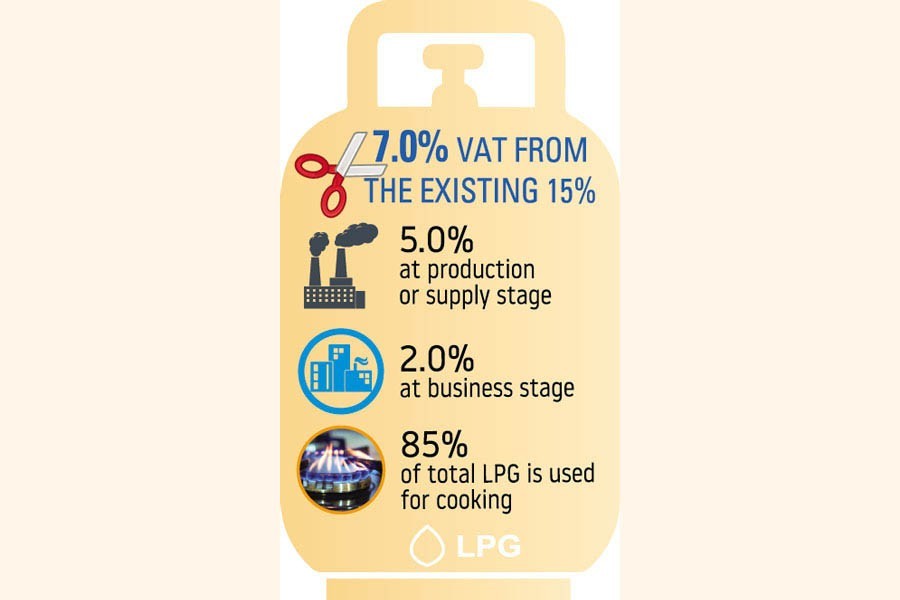

The National Board of Revenue (NBR) has decided to reduce VAT on Liquefied Petroleum Gas (LPG) to 7.0 per cent from the existing 15 per cent to make its prices affordable to the end-users.

There will be 5.0 per cent VAT at production or supply stage and 2.0 per cent VAT at business stage, once the decision is implemented.

The NBR's VAT Wing recently sent a letter in this regard to the Bangladesh Energy Regulatory Commission (BERC).

BERC Member (Gas) Maqbul-e-Elahi Chowdhury said the consumers would get the benefit of 8.0 per cent tax reduction, but local LPG prices vary in line with fluctuation in international prices.

Currently, there is 5.0 per cent VAT at retail stage, 5.0 per cent VAT at business stage, and another 5.0 per cent VAT at production or supply stage of the fuel.

The VAT officials said they sent the letter to the BERC and requested it to fix the LPG prices on the basis of the reduced VAT rate.

Officials said the VAT rate on LPG had been cut following recommendations of the BERC to facilitate distribution of the fuel among the consumers at reasonable prices.

The NBR subsequently decided to exempt VAT at consumer end, and reduced tax at business stage.

As per the High Court (HC) order, the commission would have to re-fix LPG prices at consumer level by this month.

The BERC member said the commission would try to re-fix the prices by this month, but it was allowed to take time until mid-April, according to the law.

The BERC had not set LPG prices after 2009.

Abul Hassan Khan, secretary (additional charge) of the BERC, in a letter to the NBR on March 1, 2021, proposed to consider LPG for enjoying similar tax treatment like other petroleum and pharmaceutical products.

Currently, VAT on local business stage of pharmaceutical products is 2.4 per cent, while it is 2.0 per cent for petroleum products.

In July 2019, the NBR offered reduced VAT rates and eased collection process for other petroleum products including diesel, kerosene, octane, petrol and furnace oil.

However, LPG remained out of the purview of the benefit.

The VAT officials said the wing now included LPG in the list of petroleum products following the BERC's request.

The HC ordered the BERC on August 25, 2020 to fix LPG prices after holding a public hearing.

On January 14, the BERC held a public hearing on re-fixing LPG prices as per Section 34 (4) of the BERC Act 2003.

In the hearing, the private sector LPG storage and bottling companies as well as other stakeholders questioned justification of VAT on the fuel at three stages, the BERC letter mentioned.

In the hearing, the BERC Technical Evaluation Committee suggested setting the price of each 12-kg LPG cylinder at Tk 954 as the highest and Tk 758 as the lowest for the private sector companies from the current price of Tk 1,259.

The regulator also recommended setting the price of each 12.5-kg container of the LP Gas Limited, an entity of the state-owned Bangladesh Petroleum Corporation, at Tk 902 from the current price of Tk 600 by giving a cross-subsidy of Tk 333.

In the letter, the BERC also urged the NBR to allow the LPG importing, storing and bottling companies to collect the total VAT at the time of supplying the product to the distributors and dealers.

The commission requested the board to take the measure, as other petroleum products were enjoying the same facility.

Currently, around 85 per cent of the total LPG is used in household cooking purpose.

According to the BERC, per capita consumption of LPG in Bangladesh is one of the lowest (4.0 kg) in the region, which is 58 kg in Japan, 16 kg in India and 13kg in Vietnam.