Published :

Updated :

Bangladesh feels unrelenting inflationary pressure from price rises both at home and abroad and economists say the situation could slip out of control unless monetary-policy mechanisms are applied.

Analysts say the unruly inflation irks many policymakers and economists alike as it upends family upkeep accounts and makes living hard especially for the fixed-income group.

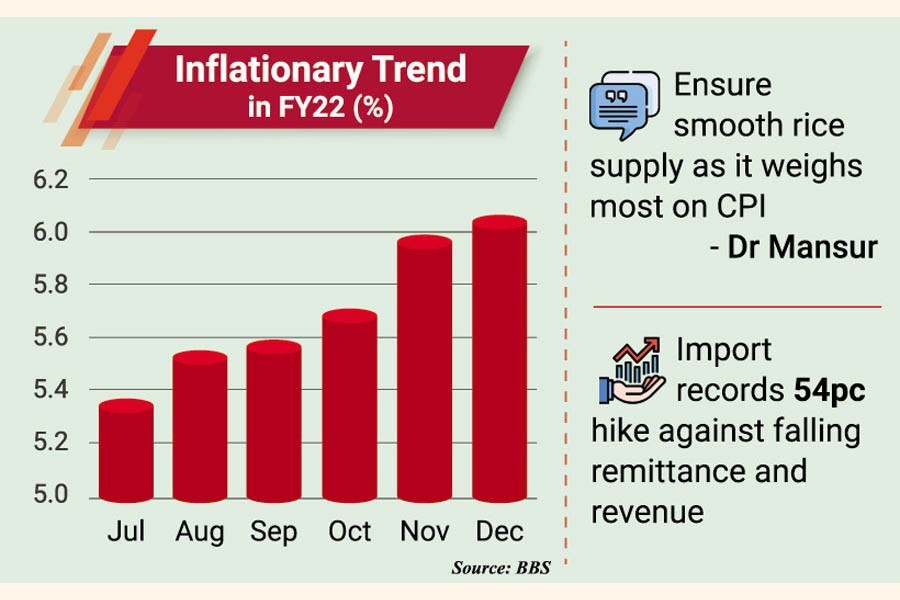

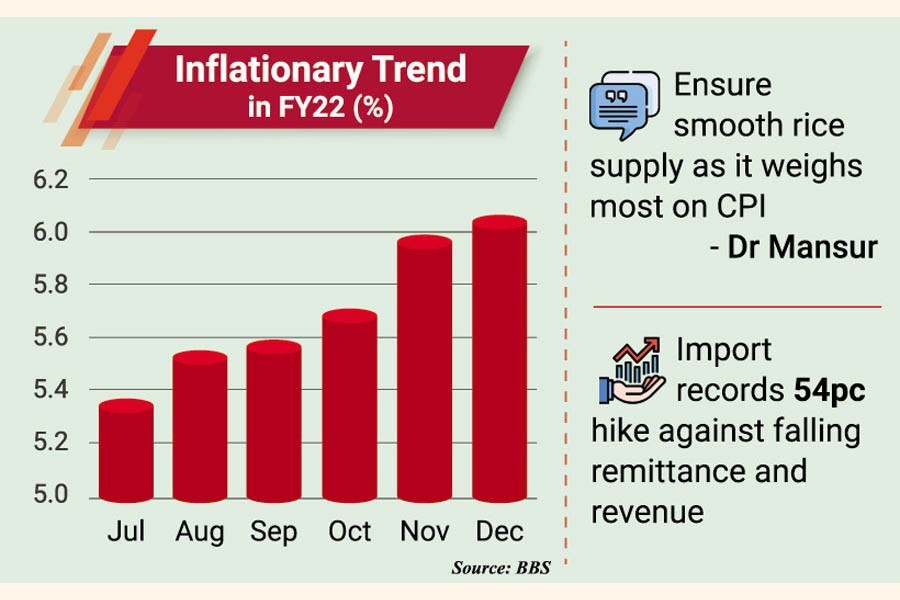

Despite limited government market intervention, prices keep rising with the indices already having read 6.05 per cent in December.

Meanwhile, in the outer world, authorities are tracing a link between rocketing prices and 'corporate power' over the market.

In the month of December, the point-to-point inflation surged into the 6.0-per bracket after the first five months of the current fiscal year (FY) 2021-22, the analysts noted, though they take official data with a grain of salt.

According to Bangladesh Bureau of Statistics (BBS), the rate of inflation rose to 6.05 per cent in December, against previous month's 5.98 per cent.

The rate in the same period (December) of last FY2021 was 5.29 per cent, the BBS data show.

Economists sound a note of caution for the government over the higher inflationary trend and suggest applying prudent monetary policy and demand-side management to tame the wayward consumer price index (CPI).

Development partners, including the World Bank, the International Monetary Fund and the Asian Development Bank, also cautioned about the inflationary pressure as they forecast a further hike in the CPI in Bangladesh.

They said the government should go for controlling price and apply sound monetary mechanisms to check the CPI prance over the last six months of the current FY2022.

Executive Director of the Policy Research Institute (PRI) Dr Ahsan H Mansur says it is really a "caution for us" as the inflation has been rising over the months.

"The global price index is rising. The demand-side management is poor. The import is rising and the local currency has depreciated. So, there is short-term and mid-term forecast of rising the inflation more in the coming months," he told the FE.

On the demand side, Dr Mansur suggests that the government should go for ensuring smooth rice supply as there is the highest weight of the food item on the CPI.

Since Bangladesh's import has already recorded some 54-per cent hike against the falling remittance and revenue income, there is grim picture of financial management, which would add pressure onto the inflation barometer, the economist says.

"The government has prepared the national budget with 6.2-per cent deficit. Nearly Tk 700-billion funds are kept aside for subsidy alone. Besides, it has announced more than 1.0-trillion stimulus packages. Amid lower revenue collection, the government may need to inject more money into the financial market printing new currencies, which will add more pressure to inflation," Dr Mansur says about cascading impacts of inflation.

Centre for Policy Dialogue Research Director Dr Khandker G Moazzem told the FE that there is no short-time space of getting the CPI down.

"Despite the Aman rice production a month ago, we are still seeing higher rice price. Besides, the oil-price impact will raise the cost of next Boro cultivation, to be harvested in March-April. So, there is a possibility of further inflation uplift," he says.

He terms BBS's inflation data faulty as "when we see the food inflation rising, then the non-food inflation is coming down".

This is interceding in the case of Bangladesh unlike the other South Asian nations, he says.

The CPD researcher suggests that the government ensure smooth rice supply on the market even through import and prudent monetary policy to weather the higher inflationary pressure.

Meanwhile, the average inflation in the calendar year 2021 was recorded at 5.54 per cent compared to 5.69 per cent in the last year 2020.

Though the average inflation last year dropped compared to the previous year, there is uncertainty over the target of keeping the average inflation within 5.30 per cent rate, set by the government for the FY2022.

Inflation has been on the rise since July 2021 as it was recorded higher in the previous month (June) 5.64 per cent.

In December, the food prices rose 5.46 per cent and non-food items a record 7.0 per cent within the recent past. The figures were 5.34 per cent and 5.21 per cent in the corresponding period in 2020.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.