Stocks witnessed a big fall last week that ended Thursday with sluggish trading activities as selling mood gripped the investors throughout the week.

Market operators said the market plunged as investors mostly refrained from injecting fresh funds into the market amid anticipation that the Bangladesh Bank (BB) may take measures in the upcoming monetary policy to curb credit growth.

"The risk-averse investors went on selling spree, especially the heavyweight banking sector issues, taking the core index below 6,200-mark once again," said an analyst at a leading brokerage firm.

According to media reports, the central bank plans to rein in liquidity flow by cutting advance deposit ratio (ADR) to avert inflationary risk amid high growth in the private sector credit. The measure may come in the upcoming monetary policy for January-June.

The ADR issue put a damper on the capital market keeping the daily turnover below Tk 5.0 billion throughout the week, the analyst said.

"News broke that the central bank would tighten the credit to deposit ratios for banks, in order to stop any potential liquidity crisis. This had an adverse reaction on the banking sector stocks," commented LankaBangla Securities, a stockbroker, in its weekly analysis.

The stockbroker noted that institutional fund flow into the capital will almost certainly be negatively impacted by this.

The week featured five trading sessions as usual. Of them, first four sessions closed lower while last one saw marginal gain.

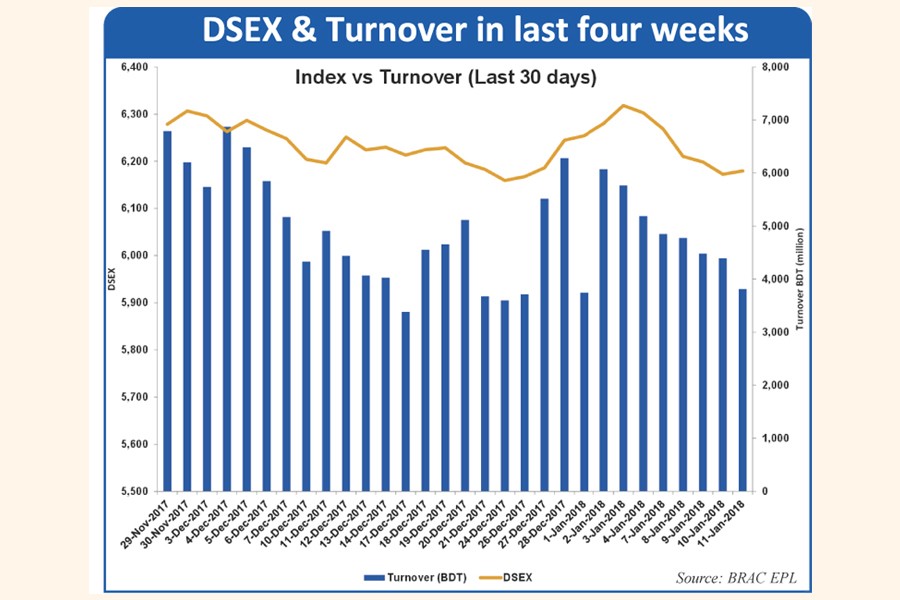

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down more than 123 points or 1.96 per cent to finish at 6,179.

The two other indices also ended lower. The DSE 30 Index comprising blue chips fell nearly 42 points or 1.82 per cent to settle at 2,253. The DSE Shariah Index (DSES) also lost 16 points or 1.14 per cent to close at 1,391.

The port city bourse Chittagong Stock Exchange (CSE) also ended lower with CSE All Share Price Index -- (CAPSI) - slumping by 397 points or 2.03 per cent to finish at 19,098.

The Selective Categories Index of the port city bourse -- CSCX, also lost 247 points or 2.32 per cent to close at 11,536.

Daily turnover averaged Tk 4.46 billion, which was more than 14 per cent lower than the previous week's average of Tk 5.19 billion.

Banking sector kept its dominance over the turnover chart, capturing 19 per cent of the week's total turnover, followed by textile with 17 per cent and engineering 16 per cent.

According to EBL Securities, some macroeconomic aspects like increasing gold price and rising oil price in the international market have raised red flag.

"The investors opted to liquidate their holdings, especially from bank, non-bank financial institutions, fuel & power, textile and engineering sectors in anticipation of further fall ahead of quarter-end earnings disclosures and year-end dividend declarations," said International Leasing Securities.

Among the major sectors, the banking sector posted the highest correction of 3.92 per cent, followed by non-bank financial institutions with 3.07 per cent, fuel & power 2.81 per cent, textile 1.46 per cent and engineering 1.04 per cent.

The market capitalisation of the DSE also fell 1.48 per cent as it was Tk 4,272 billion on opening day of the week while it came down to Tk 4,209 billion Thursday.

The losers took a strong lead over the gainers as out of 338 issues traded, 242 closed lower, 78 closed higher and 18 issues remained unchanged on the DSE trading floor.

IFAD Autos topped the week's turnover chart with 7.21 million shares worth Tk 961 million changing hands, closely followed by United Power with Tk 723 million, Paramount Textile Tk 703 million, National Tubes Tk 653 million and Square Pharmaceuticals Tk 593 million.

Jute Spinners, a 'Z' category company, was the week's top gainer, posting a gain of 20.06 per cent while Alif Manufacturing Company was the week's worst loser, slumping by 15.38 per cent.