Stocks kept the positive trend for the fourth straight week that ended on Thursday despite the last four sessions of the week witnessed profit booking sell-offs.

The week featured five trading sessions as usual. Of them, the first session gained 37.86 points while last four eroded 30.31 points.

Week-on-week, DSEX, the key index of the Dhaka Stock Exchange, went up by 7.55 points or 0.19 per cent to settle the week at 4,069.

The core index added a cumulative around 105 points or 2.70 per cent in the four consecutive weeks.

The DSE Shariah Index also advanced 6.85 points to settle at 945. However, DS30 index, comprising blue chips, saw a fractional loss of 0.61 point to close at 1,368.

Market operators said stocks managed to edge higher as the last four sessions' losses failed to offset the first session's gain.

The securities regulator's ultimatum to non-compliant directors of listed firms to ensure holding of minimum 2.0 per cent shares within 45 days led the buying pressure in the opening day of the week, said a leading broker.

The securities regulator has recently asked 61 directors of 22 listed companies to ensure a minimum 2.0 per cent shares in their own companies within 45 days to continue their directorship.

The central bank's recent directive on easing foreign investment also created a positive impact, said a merchant banker.

However, the market started to fall from the second day of the week as risk-averse investors opted for quick-profit on selective issues amid ongoing virus fears.

"The cautious investors booked quick-profit on majors sectors' issues, which saw substantial gain the past few trading sessions," said a merchant banker.

He noted that some investors, however, remained active on the market riding on optimism owing to the gradual reopening of the economy and revival of some specific sectors' activity.

UCB Capital Management said investors oscillated between optimism and cautiousness as the economy gradually reopens, commented.

The total turnover, a crucial indicator of the market, stood at Tk 15.08 billion as against the previous week's total turnover of Tk 9.41 billion.

The daily turnover averaged Tk 3.01 billion, which was 60 per cent higher than the previous week's average of Tk 1.88 million.

Block trade contributed 12 per cent to the total weekly turnover, where stocks like BATBC, Beacon Pharma, Paramount Insurance and Eastern Bank dominated the block trade board.

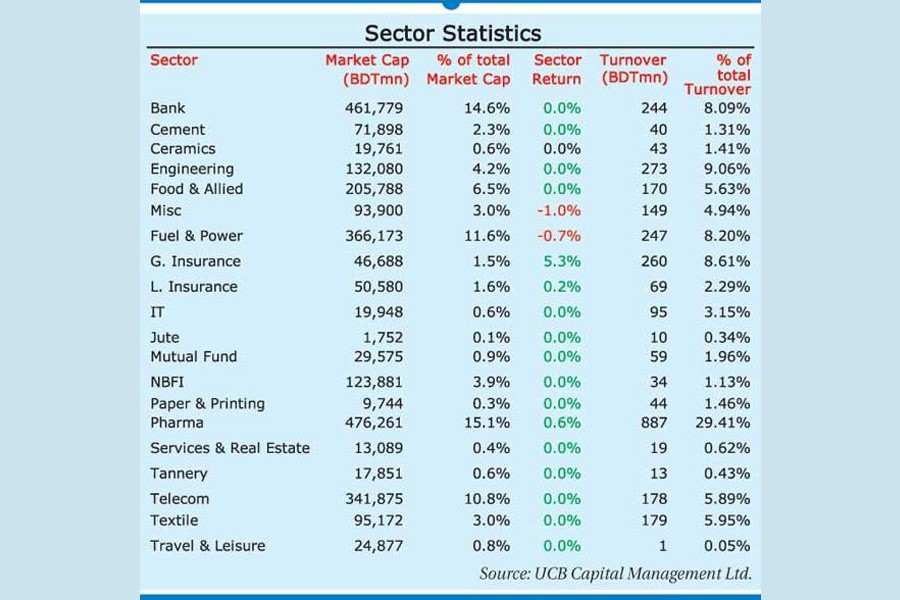

Among the major sectors, IT witnessed the highest gain of 1.52 per cent, followed by telecom with 1.06 per cent, textile 0.87 per cent, pharma 0.57 per cent and banking 0.23 per cent.

Financial Institutions, power, engineering and cement took most of the beating, losing 1.0 per cent, 0.70 per cent, 0.04 per cent and 0.10 per cent respectively.

Most of the shares, however, remained stuck at the trading floor amid regulator-set floor price. Of the traded issues, 179 remained unchanged while 79 issues advanced and 100 declined on the DSE.

The market capitalisation of the DSE went up to Tk 3,154 billion Thursday, from Tk 3,150 billion in the previous week.

Beximco Pharma dominated the week's turnover chart with shares worth Tk 805 million changing hands, followed by Square Pharma, Indo-Bangla Pharma, Bangladesh Submarine Cable, and Grameenphone.

GQ Ball Pen was the week's best performer, posting 39.51 per cent while Dacca Dyeing was the week's worst loser, losing 20.83 per cent.

The Chittagong Stock Exchange (CSE) also edged higher with its CSE All Share Price Index - CASPI -gaining 23 points to settle at 11,559 and the Selective Categories Index - CSCX rising 18 points to close at 7007.

Of the issues traded, 64 gained, 66 declined and 142 remained unchanged on the CSE.

The port city's bourse traded 24.96 million shares and mutual fund units with a turnover value of Tk 649 million.