Published :

Updated :

Stocks nosedived last week that ended Thursday, after single-week break, as investors sold shares throughout the week amid ongoing liquidity shortage.

Market operators said the persistent liquidity shortage coupled with ongoing pessimism kept investors mostly inactive, taking the key index below 6,000-mark once again with sluggish turnover.

"The ongoing liquidity shortage in the banking sector pushed banks' deposit interest rate high in recent weeks and lured many investors to put money in banks instead of investing capital market, bringing average daily turnover record low," said an analyst, seeking anonymity.

"Sharp price correction of the largest market-cap GP's shares fuelled the overall market fall as the largest market-cap company affects the index largely," said the analyst.

Grameenphone's share price plunged 4.57 per cent or Tk 23.10 each to close at Tk 482 on Thursday.

The central bank's move to extend the deadline for lowering the banks' loan-deposit ratio for six months till December 31, 2018, also failed to boost investors' participation rather turnover hit 20-months low on Thursday.

The Bangladesh Bank (BB) on Tuesday extended the deadline for banks to lower their loan-deposit ratio to December 31 from June 30.

The market witnessed four trading days instead of five as the market remained closed Wednesday due to public holiday on the occasion of International Mother Language Day. All four sessions closed lower.

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 143 points or 2.37 per cent to settle at 5,907 over the previous week.

According to EBL Securities, the market saw a major fall following the liquidity shortage in the market and upward trend on the interest rate on banks deposit.

The stockbroker noted that majority of the investors took stance on the sidelines throughout the week as they undertook cautious approach.

Two other indices of the premier bourse also ended lower. The DS30 index, comprising blue chips, fell 60.67 points to finish at 2,170 and DSES (Shariah) shed 30 points to settle at 1,375.

The port city bourse Chittagong Stock Exchange (CSE) also ended lower with the CSE All Share Price Index - CASPI - falling 471 points to settle at 18,251 and Selective Categories Index - CSCX -losing 278 points to finish at 11,019.

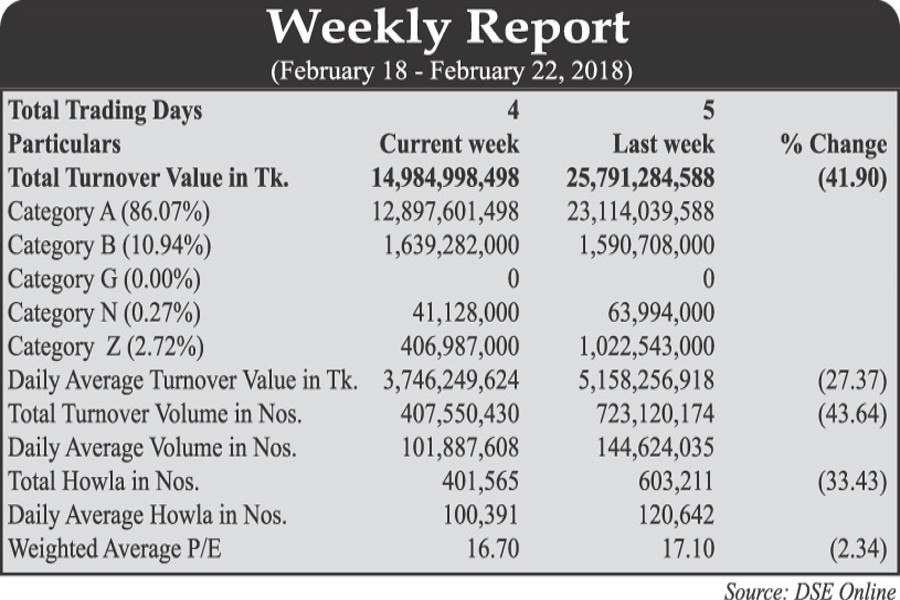

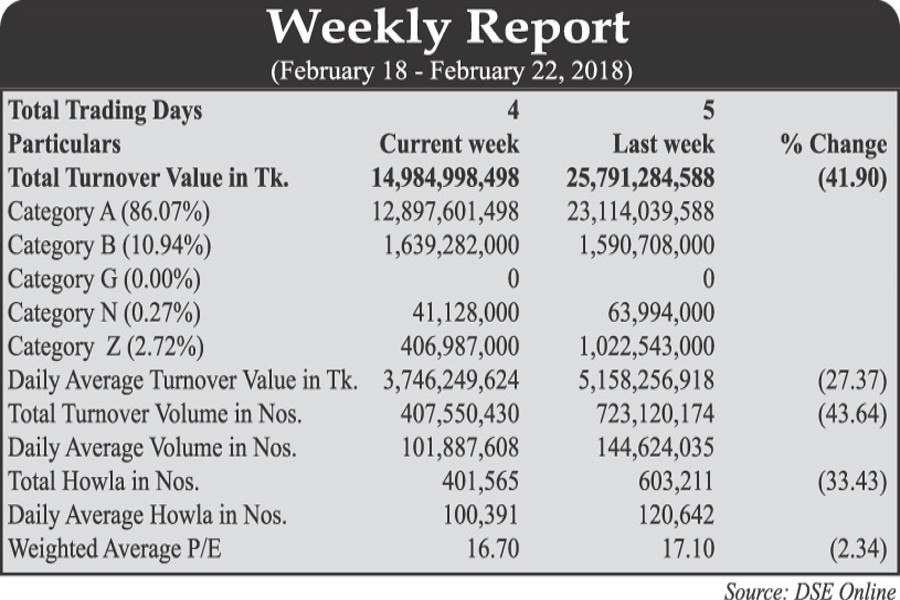

Bearish sentiment was also reflected on the trading activities as total turnover on the DSE came down to Tk 18.98 billion which was Tk 25.79 billion in the week before. However, last week saw four trading sessions instead of previous week's five.

The daily turnover averaged Tk 3.38 billion, which was more than 27 per cent lower than the previous week's average of Tk 5.15 billion.

"Turnover declined sharply as the last trading day of the week recorded nearly 20-month low showcasing investors' pessimism coupled with liquidity shortage," commented City Bank Capital Resources, a merchant bank, in its weekly analysis.

The merchant bank noted that the market remained dry amid the tension to select Chinese consortium to be Dhaka bourse's strategic partner which finally settled with DSE board's 'reconfirmation'. DSE also submitted the proposal to the securities regulator.

Only one listed company-Reliance Insurance recommended dividend last week. The company recommended 15 per cent cash and 10 per cent stock dividend for the year ended on December 31, 2017.

The textile sector dominated the turnover chart, grabbing 15 per cent of the week's total turnover, closely followed by pharmaceuticals with 14 per cent and banking 13 per cent.

The market capitalisation of the DSE also fell 1.97 per cent as it was Tk 4,177 billion on opening day of the week while it stood at Tk 4,095 billion on Thursday.

Losers outnumbered gainers by 277 to 55, with 6 issues remaining unchanged on the DSE floor.

Unique Hotel & Resorts topped the week's turnover chart with 10.03 million shares worth nearly Tk 630 million changing hands, followed by Square Pharmaceuticals with Tk 430 million, CVO Petrochemicals Refinery Tk 411 million, Grameenphone Tk 399 million and Fu-Wang Food Tk 377 million.

Apex Spinning & Knitting Mills was the week's best performer, posting a gain of 14.10 per cent while Bangas was the week's worst loser, slumping by 16.55 per cent.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.