Published :

Updated :

Bangladesh taka tumbles in the biggest single-day depreciation against the US dollar as the regulator relaxed exchange rate and raised price of the greenback by Tk 7.00 to Tk 117.

Under a reform recipe evidently shaped in line with IMF loan terms, the central bank Wednesday also announced another decision deregulating interest rate to be fully market-driven.

The abrupt leap in the taka-dollar exchange rate comes after the Bangladesh Bank (BB) launched crawling-peg exchange-rate system avowedly to reduce the prevailing volatility on the forex (foreign currencies exchange) market.

In the third meeting of the Monetary Policy Committee (MPC) in the ongoing fiscal year (FY'24), BB decided to introduce the interim exchange-rate-management system for buy and sale of foreign currencies. The central bank governor, Abdur Rouf Talukder, chaired the meeting held Wednesday at the BB headquarters.

Consequent on the decision, the Bangladeshi currency weakened 5.98 per cent in a single day, although the value of taka had decreased 5.77 per cent in the entire past year of 2023.

According to the resolution of the MPC meeting, under the new system, a Crawling Peg Mid-Rate (CPMR) is set at Tk 117.00 per US dollar.

"The central bank will keep under watch the new regime and adjust the parameters of the regime as and when needed," says a BB official.

The BB decision states that "the crawling-peg system will be an interim arrangement before moving into a fully flexible market- based system in the near future".

Sources at the BB said the central bank stepped into the new exchange- management regime following one of IMF's (International Monetary Fund) prescriptions for moving towards fully market-centric exchange- rate system.

Alongside the exchange rate, the central bank also discarded the existing reference rate or SMART for determining the lending rates for banks and nonbanks.

Uncapping the lending cap of 9.0 per cent in the banking industry, the central bank had introduced the SMART (six-month moving average rate of treasuries) with effect from this financial year.

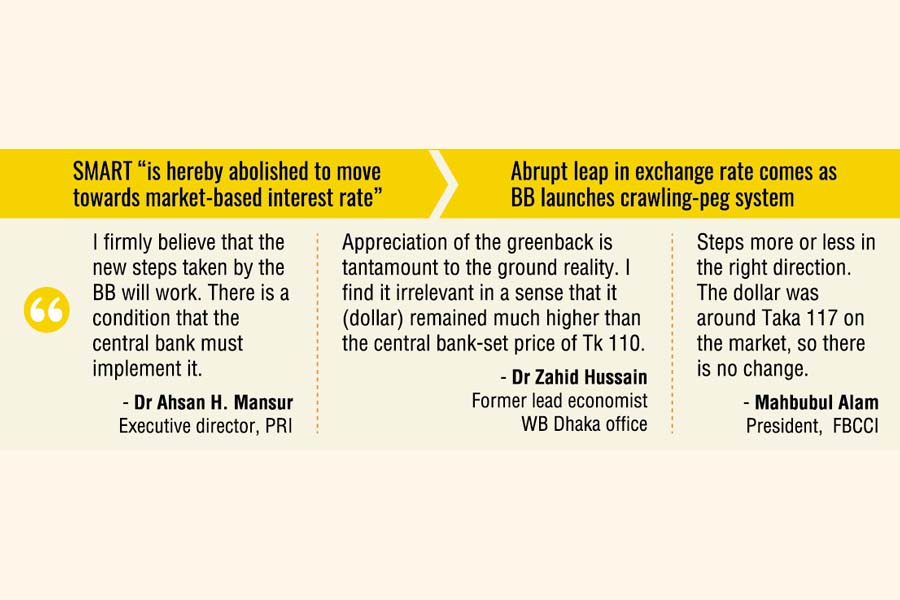

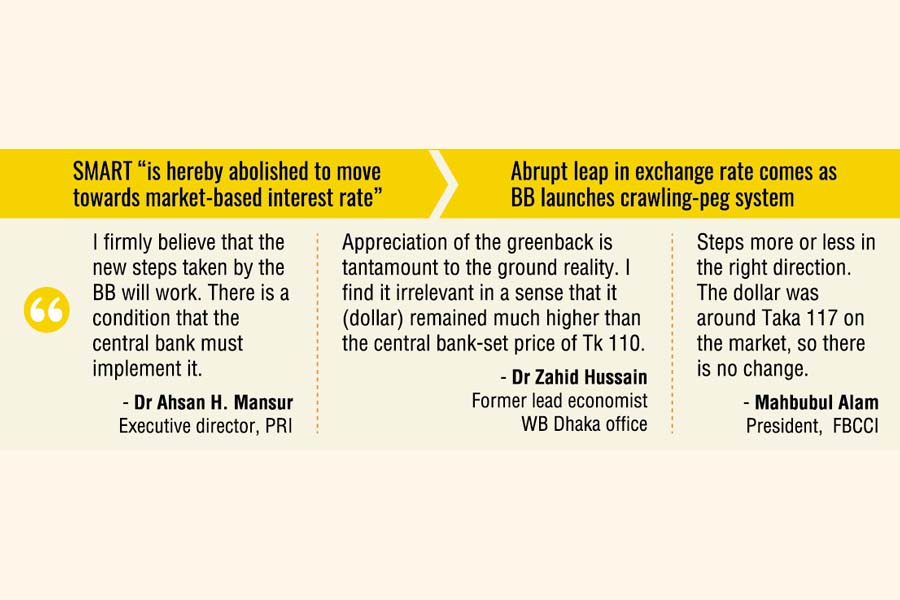

The MPC resolution states that the existing reference rate, SMART, for determining the lending rates of banks/NBFIs "is hereby abolished to move towards market-based interest rate". "Banks and NBFIs can set interest rates based on the interaction of demand and supply on the market as well as banker-client relationship," the resolution reads.

To anchor inflation expectations at the desired level, the central bank revised the existing Interest Rate Corridor (IRC) raising policy rate by 50 basis points to 8.50 per cent.

Because of the rise, the upper ceiling of the IRC, called Standing Lending Facility (SLF), has also increased by 50 basis points to 10.00 per cent from 9.50 per cent while its floor rate, known as Standing Deposit Facility (SDF), got enhanced by 50 basis points to 7.00 per cent from 6.50 per cent.

Economists welcome the monetary steps taken by the central bank on hope that the course of cure will work to stabilise the financial market, provided the initiatives are implemented firmly. They think the central bank should have done it at least one year before and could avoid present volatility on the money market.

"I firmly believe that the new steps taken by the BB will work," says Dr Ahsan H. Mansur, executive director of the Policy Research Institute of Bangladesh or PRI, a private think-tank. He says there is a condition that the central bank must implement it.

Dr Mansur feels that the policy rate should have been hiked more aggressively. "I proposed it should be at least a 200-basis-point hike at one go."

The economist explains his point: "Banks will take funds at a rate of 8.5 per cent and lend it 15 per cent. Can we justify it?" He notes that the policy- rate enhancement may play a strong role in containing the inflation persisting in the country for a long time.

On the market-based interest rate, he appeared rather a bit confused as to whether the central bank may phone or intervene the banks to fix the rate of interest.

Now the exchange rate is committed to be flexible or a crawling peg. "Once there is no intervention, the forex market may be stabilised," he says on a note of cautious optimism.

He hopes now the local currency or BDT will be more attractive as the central bank has removed the benchmark or popularly called "SMART".

And once the taka becomes attractive, it will lead to stabilising the foreign-exchange market. "Ultimately, it brings down the rate of inflation on the economy."

Dr Zahid Hussain, former lead economist of the World Bank, also welcomes the steps. But he thinks the appreciation of the greenback is tantamount to the ground reality.

"I find it irrelevant in a sense that it (dollar) remained much higher than the central bank-set price of taka 110.

"We are now closer to the reality in terms of dollar pricing."

Dr Hussain says making the SMART dysfunctional is also in the right direction as it was a barrier to making the interest regime market-based. Now the depositors will get more money for deposits and local currency will be attractive and asset-worthy.

President of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) Mahbubul Alam also appreciates the steps as being more or less in the right direction. The president of the apex chamber told the FE that "the dollar was around Taka 117 on the market so there is no change".

"Once it becomes Taka 125 then it will be a problem for the importers."

Leader of the country's apex trade body said the appreciation is conducive to the exporters and Bangladeshi expatriates who send foreign currencies to the country. "When local currency weakens against dollar, they get much money (taka) against their currencies."

He thinks that a policy-rate rise may help contain inflation.

Earlier, the BB arranged a press briefing for informing media professionals about the decisions of the MPC meeting but the journalists walked out from the briefing on protest against restrictions on reporters' entry into the BB.

jaimharoon@yahoo.com and jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.