An analysis of loss of revenues incurred in the incentives provided to industries is to begin soon to help prune the waiver facility prudently.

The International Monetary Fund (IMF) and the Asian Development Bank (ADB) are giving the joint backup to the National Board of Revenue (NBR) to build capacity of the tax officials to conduct the intensive analysis and other exercises.

Officials have said it is part of NBR's preparation to comply with the conditions of the IMF related to the US$4.7 billion worth of credit support to Bangladesh, sought in the wake of strains on the country's foreign-exchange reserves amid a global financial crunch.

Government revenue losses stem from tax exclusions, exemptions, deductions, credits, deferrals and preferential tax rates.

A technical-assistance mission of the IMF recently pledged to support the NBR on tax- expenditure analysis from February 26 to March 2, 2023. They will hold a workshop to impart training to 15 NBR officials, five each from Income tax, customs and VAT wings.

Tax officials hope they would be able to cut down the tax exemptions on the basis of data and analyses in the budget for the upcoming fiscal year with the support.

The IMF suggested lowering the tax exemptions and increasing country's tax-GDP ratio by 2026 along with other major conditions packaged in the aid programme.

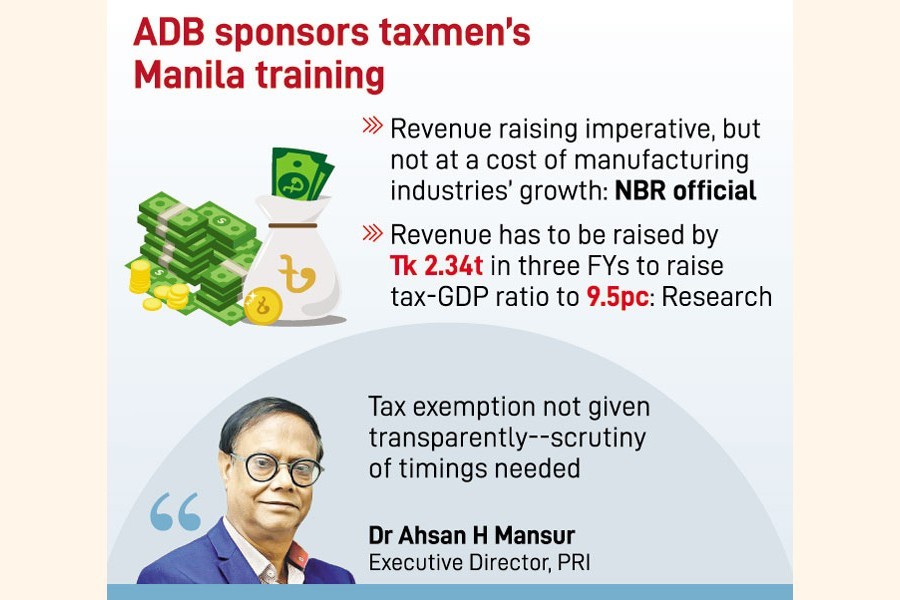

"The NBR will have to collect additional revenues but not at a cost of growth of local manufacturing industries," said a senior tax official about a soft handling of the tasks.

The tax authority will have to sort out the sectors enjoying benefits for a long time and its impact on the economy, he added.

A team of taxmen is scheduled to fly to Manila in the last week of this month (February) to attend an ADB-sponsored training programme on tips to go along executing the reform modalities, officials said about the dress rehearsal on reforms.

"IMF and ADB would provide technical assistance to the NBR to develop tool of data mining and conduct sector-based analysis of tax exemptions," said the NBR official.

Earlier, the revenue board had conducted a study on a limited scale on tax expenditures which hardly unveiled the full picture of the expenditures incurred on this account.

Noted economist Dr Ahsan H Mansur suggests reviewing entire range of tax exemptions so far offered by the NBR to make transparent statements on the facility.

"The NBR should conduct scrutiny of the time-bound tax exemptions, its phases of extensions, time of expiry instead of primary judgment on the facility," says Dr Mansur, Executive Director of the Policy Research Institute (PRI).

The tax exemptions should come through parliament where statements on volume of net tax waivers must be written clearly, he adds.

Mr Mansur, who had once worked with the IMF, thinks that currently the tax-exemption facility is not given in a transparent way.

A recent study by the PRI said the NBR would have to enhance domestic revenues worth Tk 2.34 trillion over the next three years from current FY to comply with the IMF-set conditions concerning the $4.7-billion loan approved recently.

The country will have to increase the tax-to-GDP ratio by 1.7 percentage points to 9.5 per cent at the end of the fiscal year 2025-26.

Currently, the tax-GDP ratio in Bangladesh is 7.9 per cent that is one of the lowest in the world.

During the last five FYs, the NBR on average registered around 12-percent annual growth in tax collection. In the first six months of the current FY, tax-collection growth was 11per cent. The budgetary target for tax revenue in FY2022-23 is Tk 3.7 trillion.

According to NBR study, tax waivers eat up 2.3 per cent of tax GDP of Bangladesh.