As expected, Finance Minister AMA Muhith, on Thursday, in keeping with the past trend, placed even a bigger budget for fiscal year (FY) 2018-19 that appears benign, in terms of tax proposals, and selective in its business-friendly approach.

The proposed budget that belied speculations can be termed anything but populist one, ahead of the next general election.

The budget also does not offend the taxpayers in general.

It has proposed certain tax measures with a view to giving protection to a number of domestic industries. There are, of course, a few harsh tax proposals aimed at certain items, including tobacco, polythene bags and energy drinks.

The proposed budget, however, has not tried to address a few key challenges, particularly coming from the banking sector and the capital market.

Much to the disappointment of many, the finance minister made cursory observations about both banking sector and capital market.

Experts are unanimous that until and unless the affairs of these two sectors are streamlined, the economy would not be able to move ahead at a healthy pace.

In line with the promise he had made earlier, the finance minister proposed a cut in the corporate tax rate. But he has targeted banks and financial institutions as only beneficiaries of the rate-cut.

This could generate a sense of discrimination among other segments of the corporate world.

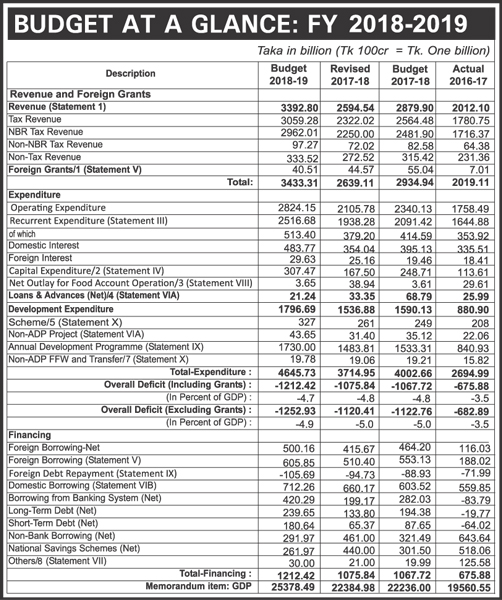

Mr. Muhith, in the proposed budget for the next FY, intends to spend Tk. 4.64 trillion.

Of the amount, 63.7 per cent is projected to come as tax revenue (NBR), 7.2 per cent as non-tax revenue, 15.3 per cent as domestic loans and 1.8 per cent as foreign loans.

The expenditure pattern, followed in the budget for the next fiscal, remains almost identical to the past budgets.

In the 'operating budget', pay and allowances of government servants top the expenditure chart (20.5 per cent), followed by interest payments (18 per cent) and subsidies and incentives (11.7 per cent)

However, his plan looks ambitious, given the government's capacity to generate resources and spend the same.

As far as generation of tax revenue is concerned, the performance of the National Board of Revenue (NBR) does not make one that much hopeful about meeting the next fiscal's target.

In the first nine months of the outgoing fiscal, the board could achieve nearly 63 per cent of the revised target and far less of the original budget.

Yet Mr. Muhith has pinned much of his hope on the 'increased rate of tax compliance', particularly by the youths, and a revamped tax administration.

Besides, the capacity of the government to execute the big budgets has also come under focus in recent years.

Mr. Muhith, too, in his budget-presentation speech did mention the issue as, according to him, the government could spend only 45 per cent of the revised budget in the first nine months of FY 2017-18.

He, however, was hopeful about 'dynamism' in the budget execution in the remaining months of the outgoing fiscal.

Such expectation is somewhat misplaced as the size of the government, in terms of performance, is now shrinking and not expanding that the mega budgets tend to demonstrate.

All -- budgetary receipts, expenditure and fiscal deficit -- in proportion to gross domestic product (GDP), in the first nine months of the outgoing fiscal, were much below their projections made in the original as well as revised budgets for the outgoing fiscal.

The total revenue receipts in FY 2017-18 were projected to be 13 per cent of the GDP in the original budget and 11.6 per cent in the revised budget. The actual receipts in nine months were equivalent to 7.2 per cent of GDP.

Similarly, the ratio of expenditures to GDP during nine months was only 7.5 per cent vis-à-vis 18 per cent and 16.6 per cent respectively projected in the original and revised budgets for the outgoing fiscal. The budget deficit was also as low as 0.2 per cent as against the estimated 5.0 per cent of GDP.

The overall expenditure structure of the next fiscal's budget, more or less, is in line with that of the recent budgets of the incumbent government.

Social infrastructure got 27.34 per cent of the entire budgetary resources and nearly a quarter of the allocation has been earmarked for human resource development.

The physical infrastructure is set to receive 31 per cent of the total allocation of the next budget.

Mr. Muhith, who has placed a record 10 budgets in a row as the finance minister, spoke in an emotion-choked voice while concluding his budget speech in the Jatiya Sangsad (national parliament) on Thursday. One might get an indication from his speech that this could be his last budget.