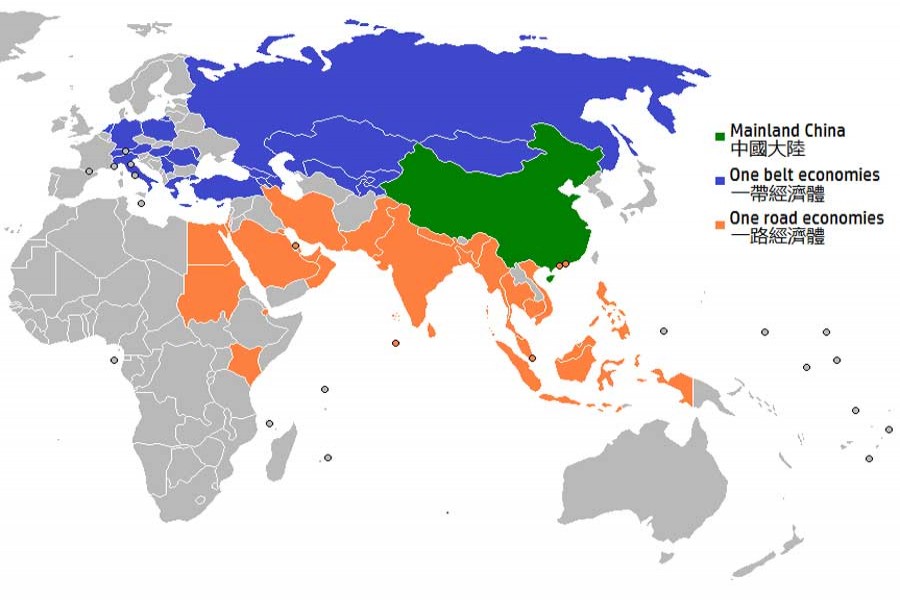

China's Belt-Road Initiative (BRI) may have girdled the globe, thus facilitating economic flows, but it is beginning to feel country-specific pinches along the entire route. From Africa to Asia, grumbles have begun to be openly aired about the costs, and Beijing's defensive responses have only just begun. If these can be contained, the entire BRI project may end up wielding more benefits than costs; but otherwise, costs may turn into conflicts.

What is plaguing the BRI project is, by opening up hitherto undeveloped areas or sectors in less-developed countries, it is also spiking demands of new goods, often luxury goods, to satisfy the thirst of the nouveau-riche, more often than not by those very local entrepreneurs elevated by BRI-like investments. This drains hard-earned foreign exchange, and particularly sordidly since the BRI advent opens the floodgates to wild export expansion.

Conspicuous consumption compounds the very debt accrued from constructing the BRI project. Investments of the kind are not only on borrowed money, but increasingly no-strings-attached loans at steeper rates than available in the west, for example, through the strings-attached World Bank varieties. Foreign exchange paucity and indebtedness can cut already elevated growth-rates, so no one highlights the cancer eating away the economy, but when it grows beyond control, public awareness and corrections will simply not be enough.

Ethiopia's plight was well covered in this newspaper (John Aglionby and Emily Feng, June 05, 2018): China's US$ 13 billion investments may have spawned consumer euphoria, but the growth-rate has plunged from exceptionally higher levels to a still robust 8.5 per cent in 2018 without curbing conspicuous consumption and imports. Government debt also climbed to 59 per cent of gross domestic product (GDP) from 47 per cent, even as exports expand 14 per cent annually. Since part of that borrowing has been to dam the upper reaches of the River Nile, increasingly agitated Egyptians downstream may be standing only a blink or two away from provoking conflict.

We have heard plenty of Sri Lanka defaulting on paying the US$ 1.6 billion Chinese investments on Hambantota Port construction. It culminated in the state corporation, China Merchant Ports Holdings (CMPort), grabbing a 70 per cent stake of the port as collateral on a 99-year lease (with the Sri Lanka Ports Authorities holding 30 per cent), during July 2017. In addition, CMPort would have access to 6,000 hectares of the adjoining industrial park, also opened simultaneously. If this sets a pattern across the world, as it has, China would be claiming, as it already is, a lot of real estate outside its own boundaries, with much more economic influence in its wings.

Pakistan's Gwador Port (work began in 2007, but in 2015 a connection to western China was added), and China-Pakistan-Economic Corridor, of which Gwador Port is now a crown jewel, mirror the Hambantota case: US$ 1.62 billion Chinese investment for the port, while the Gwador Special Economic Zone covering 2,292 acres, whose work began in 2016, was leased to China until 2059. Though Pakistan's government has had a very solid relationship with China for at least half a century, even when the rest of the world ignored China, a mutually satisfactory solution is nonetheless there for the taking. Only two elements may disturb that with a growing likelihood: the public's patience, especially of traditional merchants being out-priced and out-flooded in their own markets by low-waged Chinese products; and Pakistan's jihadi support in Afghanistan, which China hopes to rid of all its conflicts with an economic weapon that the Soviet Union and the United States could not achieve with military tools.

Closer to home, Burma also faces an indebtedness or so on the US$ 9.0 billion it borrowed from China for the Kyaukpku Port and economic zone. Meant to connect this Rakhine state port with Yunan in China alongside newly-built oil and gas pipelines (which partly evicted the refugees Bangladesh is sheltering), the port has been so advocated that the Burmese government only owns 30 per cent, the rest belonging, as in Hambantota, to China, this time to the Citi Group (different from the US bank of the same name). How China will help resolve the Rohingya crisis with Bangladesh, as it promised to do only days ago, is hard to fathom, but it is not the first strain in Yangon-Beijing relations: Burma's cancellation of the China-supported Myitcone Dam in 2011 for environmental reasons angered China. Chinese anger now amid the backlash Burma is facing globally for its Rohingya genocide would result in Burmese capitulation.

Be that as it may, China's tense relations with Mahathir Mohamad's Malaysia, captures, in a nutshell, the China-bred Southeast Asian quagmire against a constantly bubbling nationalism (in Malaysia, for instance, between citizens of Malay and Chinese descent, to which those of Indian stock only fuel more distrust). Mahathir has so far suspended US$ 22 billion of Chinese investment on three projects, and is probing China's relations with scandal-hit 1Malaysian Development Board (1MDB). Among the companies hit are state-owned China Communication Construction Company and China Petroleum Pipeline Bureau (another state-run outfit), while the projects include the East Coast Rail Link.

China may be ahead of its game in authoritarian Cambodia, but also faces a robust US presence in that country. It has, in addition, a Southeast Asian Business Forum through which it mediates differences between local and Chinese interests, but also remains too big a trade partner for any other country to raise too much of an alarm alone

To offset similar concerns in South Asia, where it has largely surrounded India with economic arrangements while also netting India to its economic network in the recent Wuhan Shanghai Cooperation Forum with the same bait, China launched a China-South Asia Cooperation Forum in Kunming during June 2018. Bangladesh participated in that gathering through its Dhaka Stock Exchange Chairman, Dr. Abul Hashem, and Joint Secretary of the Ministry of Finance, Mohammed Jalaluddin.

How that fares we must monitor, but more sensitive for the country is to avoid the slippery road into bartering any Bangladesh resource to China the way Ethiopia, Pakistan, and Sri Lanka have done. We profited when China picked up the Padma Bridge construction project after the World Bank rejected it. We were plucked out of global investment isolation, for which we remain grateful, but since we have a slew of other high-priority mega projects similarly begging foreign investors, we must, as we have indeed done, not lurch too far in the China direction, especially in an election year, when India, the European Union (EU), and the United States may play hard-ball to get the elections to be held according to their standards. We can stand tall by staging transparent elections on an even playing field, even if we have to dip into deficit spending.

China's overpowering presence can nowhere be avoided, but it can be deftly and delicately delayed, modified, or even exploited for higher returns for leaders without a faint heart.

Dr. Imtiaz A. Hussain is Professor & Head of the newly-built Department of Global Studies & Governance at Independent University, Bangladesh.