Published :

Updated :

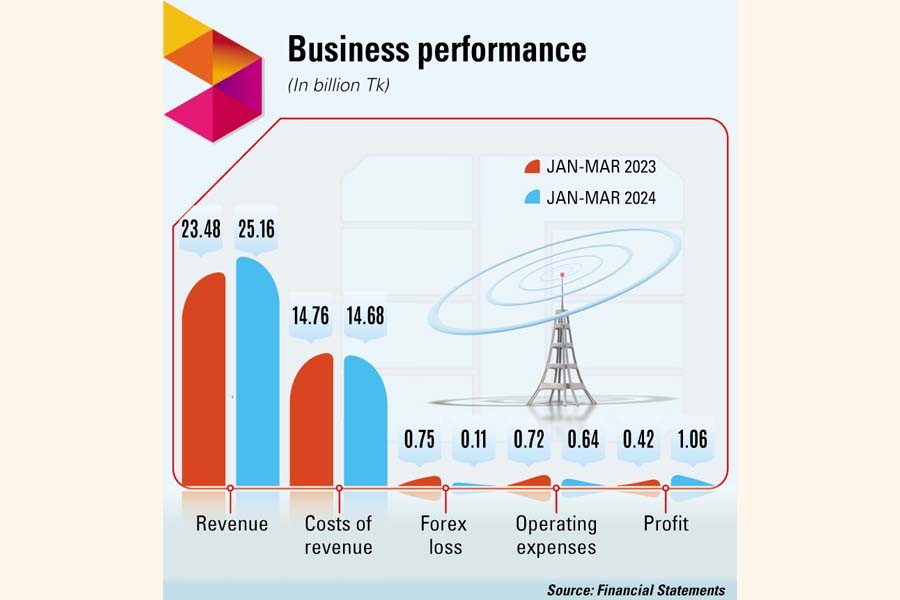

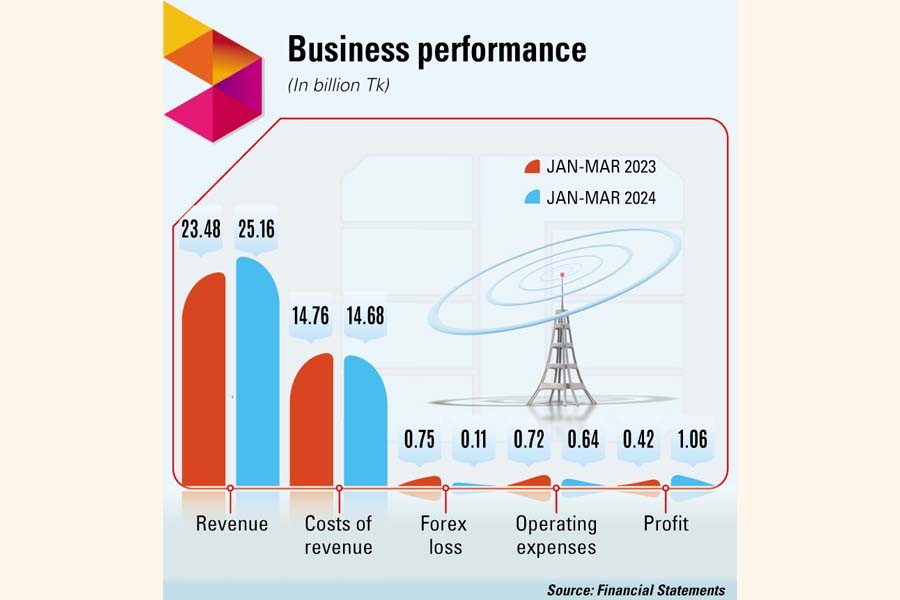

Robi Axiata posted an impressive 154 per cent year-on-year growth in profit to Tk 1.06 billion for January-March of FY24, supported by a robust revenue growth and a significant decrease in forex loss.

The second largest telecom operator registered more than 7 per cent revenue growth year-on-year to Tk 25.16 billion in the three months through March, while the data revenue shot up by 25.7 per cent indicating strong data-led growth momentum.

Foreign currency transaction loss during the quarter was significantly lower than in the same period of the previous year because the impact of the currency devaluation against the dollar and the euro was less than before.

"This stellar performance reflects the highest level of trust Robi's subscribers have for our strong network," said Rajeev Sethi, managing director and chief executive officer of Robi Axiata, in a statement posted on the company's website.

Robi's journey of digital transformation continued to gather momentum. The telecom operator has been making efforts to improve its services and expand its customer base.

The second largest telecom operator maintained the leading position when it comes to 4G subscribers. As part of the company's drive to strengthen its network, Robi has added 577 new 4G sites in the January-March quarter.

"Such focused drive to improve quality of services has resulted in Robi having more than 81 per cent of its data customers as 4G users, which is highest in the industry," reads the statement.

Moreover, more than 75 per cent of Robi's subscribers were data users for what the company claimed is its best video streaming services in the telecom industry.

"Bangladesh has a lot of room for growth in terms of data consumption when we look at the neighboring countries," said Mr Sethi.

He urged the regulator to reform the regulatory framework to facilitate substantial and speedy contribution of mobile operators towards achieving the goal of smart Bangladesh.

Mr Sethi said Robi had increased the average data speed by more than 100 per cent in the last one year. "What is particularly noteworthy is that this improvement was achieved by ensuring consistent data speed across the network and country-wide coverage."

Similarly, call drop rate also improved remarkably over the last year. "We are confident that our sustained focus on enhancing quality of services will only make our data-led growth model more effective in the market," Mr Sethi added.

For the last several years, Robi has been investing heavily on spectrum, and has expanded its digital business, making it a strong player in the industry.

Robi contributed Tk 16.05 billion to the national exchequer, equivalent to 63.8 per cent of its revenue in the quarter, in the form of taxes, VAT, duties, licence fees, and spectrum assignment fees.

Robi invested Tk 3.66 billion as capital expenditure during the quarter.

Having attained 4G leadership, Robi was the first company to launch 4.5G services in all 64 districts in 2018 and successfully conducted the first-ever trial of 5G technology in the same year.

Stock performance

Robi stock fell 1.49 per cent further on the Dhaka Stock Exchange (DSE) to Tk 26.4 per share on Monday.

It plunged 12 per cent since the removal of floor price.

The stock market regulator withdrew the price restriction from Robi on March 18 this year after more than 18 months. Robi was stuck at Tk 30 per share on the DSE during the time.

Annual profit

Robi's annual profit grew at a rate of 75 per cent year-on-year in 2023 to Tk 3.21 billion, driven by a robust 16 per cent revenue growth on inclusion of a record number of new subscribers.

Following the annual record profit, Robi declared a 10 per cent cash dividend for 2023, highest since its listing.

Amid the ongoing dollar crisis, Robi received a $55 million loan from its parent company Axiata Group last year, a Malaysian multinational telecommunications conglomerate, in a precautionary measure against any potential impact.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.