Remittances are a large source of foreign exchange receipts of the country. Since all remittances in foreign exchange have to be surrendered to Bangladesh Bank in exchange for taka, and the foreign exchange is added to the stock of international reserves held by Bangladesh Bank (BB), a misconception has developed that remittances are a fund that can be willy-nilly disposed of by the government. The financial system that we have in operation helps to create and sustain such a misconception.

To understand how this happens, it will be useful to trace the journey of remittances from the expatriate workers to their households. Assume that the workers send $1 billion through their banks overseas to the banks of their households at home. But the financial laws of the land require the banks to sell foreign exchange to BB in exchange for Bangladeshi taka of equal value. If $1=Tk 85, BB will pay for the dollar by crediting the reserve accounts of the banks with itself to the tune of Tk 85 billion. Thus, the assets of the BB increase by $1 billion and simultaneously its liabilities (reserves of the banks) also increase by the same amount in taka. The banks credit this amount to the accounts of the expatriate households. The latter then spends the money as they desire, but they do not get the foreign exchange that was sent. When they have spent the money, the entire remittances have been dissipated in the goods and services purchased by the households. How then can the remittances be a fund to be spent again by the government or anybody else?

The crucial difference between income represented by remittances and income earned in the country is that the former is earned in foreign exchange while the latter in domestic currency. The foreign exchange has to be converted into domestic currency in order to engage in transactions in the domestic market. When BB buys foreign exchange remittances from the commercial banks by crediting their accounts with equivalent taka value, it essentially creates domestic money, out of thin air so to say. This is a power only a central bank wields. The commercial banks use the money they have received from BB to pay the migrant households. The remittances in foreign exchange are added to the stock of international reserves held by BB. These add to the foreign assets component of the monetary base of the country. These are exactly matched by the liability of the domestic reserve money created by BB when it purchases the remittances. Hence, there is no change in the net asset or liability position of BB. But the international reserves can be used to pay what we owe to foreigners. Thus these represent the country's claim or purchasing power over foreign output. This is commonly interpreted as the contribution of remittances to the nation's foreign exchange reserves.

However, remittances alone do not build up the reserves; all earnings and expenditures of the economy, as well as international capital transactions, influence their quantity. An easier way to understand the nature of international reserves is provided by the balance of payments tables published regularly by BB. It shows that the sum of the current account balance and the financial account balance is the addition to the international reserves of BB. There is also a very small capital account which for our purposes could be ignored or merged with the financial account without much implication.

It is known from national income accounting that the current account balance is the excess of national saving over investment, or what might be called net national saving. The financial account balance is the excess of international capital inflow, both foreign credit and foreign investment, over similar international capital outflow. It is a comprehensive measure of the net claim on the domestic economy by foreign entities or the net international capital inflow. Since these and their returns are owned by and payable to foreign entities on liquidation, the financial account balance could be regarded in some sense as the net overseas borrowing of the country for the purpose of easier comprehension. Viewed thus, the addition to international reserves is the sum of net national saving and net borrowing from overseas. These are then comparable to the cash holdings of households, which comprise their net savings and net borrowings.

Net national saving involves all earnings (income) including remittances, and spending on final consumer and investment goods and services, government purchases, export receipts and import payments. An increase in remittances by $1 billion increases reserves by the same amount. A reduction in consumption or investment or import by $1 billion also raises the stock of reserves by the same amount. An increase in export or foreign investment also raises the reserves. What this means is that every transaction, not just remittances, influences the stock of reserves. Since the international reserves are held in foreign exchange, it is commonly misperceived as the contribution of those who earn or provide the foreign exchange.

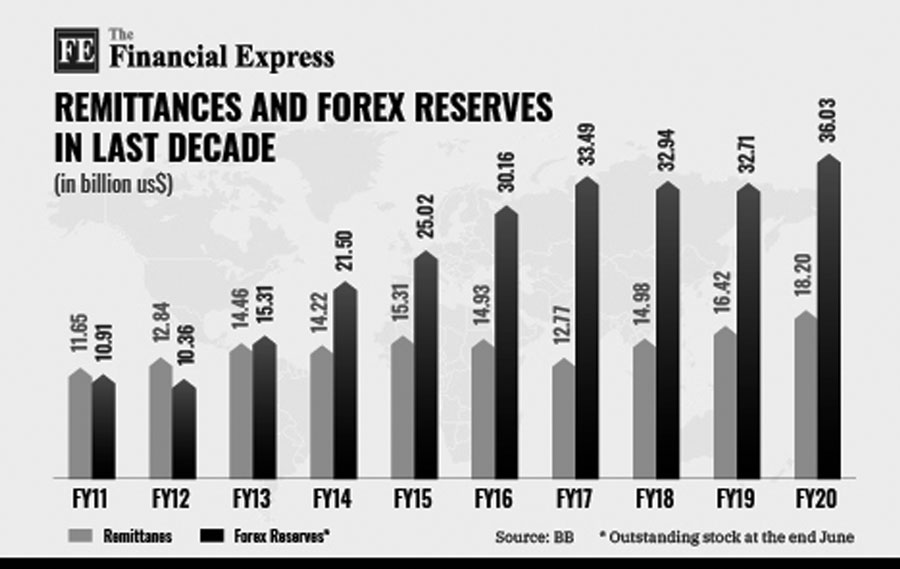

It is obvious that reserves can be inflated by foreign loans as well as foreign direct and portfolio investment since these appear as credit items in the balance of payments, and hence add to the overall balance. The recent spike in reserves despite a reduction in export is due partly to a large inflow of aid and loan money, and a decline in import in addition to an increase in remittances. On many occasions in the past, a robust inflow of remittances was accompanied by falling reserves underlining the fact that remittances alone do not determine the accumulation of the international reserves; but it is an important determinant.

A large stock of international reserves can be destabilising if much of it is foreign capital (debt), especially portfolio capital, which can be liquidated at a very short notice. The financial crises of the last four decades have shown the danger imminent in large net borrowing (capital inflow) from overseas that has a large footloose portfolio investment component. Despite having solid fundamentals, several Asian countries were destabilised during the Asian Financial Crisis late last century because of the exodus of foreign capital. Fortunately, most of the stock of international reserves of Bangladesh is its hard-earned net savings and hence immune from sudden flight. But the government should be vigilant since the situation can change fairly quickly with large budget deficits or large-scale private external borrowing.

The opening up of the foreign labour market in the 1970s has permitted millions of workers to migrate to foreign, especially Mid-Eastern countries for work. The foreign exchange remittances from them usually hog the news headlines. However, this is not the only benefit derived by the country from its expatriate workers. About one-sixth of the total households of the country, who are mostly in the relatively low income cohort, are provided directly with large income subsidies by remittances, which enable them to have a better standard of living. Importantly, a large workforce greater than the workforce of the entire manufacturing sector of the country find employment overseas that reduces pressure on the domestic labour market. These benefits suffice for the time being to warrant special attention to maintain a robust outflow of workers and inflow of remittances.

M A Taslim is a Professor of Economics, Independent University. [email protected]

[This article may be regarded as a sequel to his article titled 'Remittances, reserves and investment' published in The Financial Express on December 21, 2010. (https://today.thefinancialexpress.com.bd/public/last-page/remittances-reserves-and-investment]