Published :

Updated :

Despite the unprecedented disruptions caused by Covid-19, Bangladesh's economic growth has proved resilient. After a decade of enjoying GDP growth rate of around 7.0 per cent per year, this year's expected growth of 3.8 per cent may seem like a let-down at first glance. But considering that the global GDP is expected to shrink by 4.4 per cent in 2020 and Bangladesh's projected GDP growth rate is higher than all but two countries of the world, this is undoubtedly a phenomenal achievement.

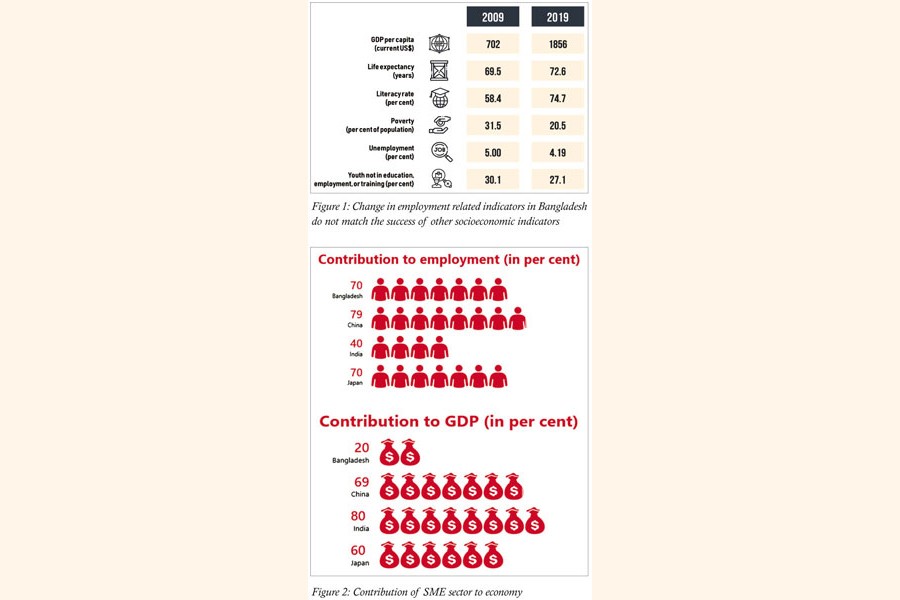

Bangladesh's sustained economic growth has led to remarkable progress in socioeconomic indicators such as per capita income growth, poverty reduction, life expectancy, literacy rate, and per capita food production. However, creating more and better employment opportunity for youth remains a challenge. While the pre-Covid unemployment rate of 4.19 per cent paints a positive picture, it does not disclose the full context. A 2019 study by General Economics Division (GED) of the Planning Commission reported the unemployment rate of 37 per cent among graduates and 34 per cent among post-graduates. The study also found the country had 13.8 million underemployed people and 27.1 per cent of youth are not in education, employment, or training - with the rate rising to 35.2 per cent for youth aged 25 to 29. As per the latest Labour Force Survey, there are about 20 million youths, who are inactive or discouraged from participating in the workforce. While the mismatch between skills and job requirement is definitely a key contributor, it is undeniable that our economy has simply not created enough quality jobs, with 85 per cent of total employment are still provided by the informal sectors. The lack of quality jobs in the private sector has led to the craze about public sector jobs, which is further widening the chasm between skill and job requirements. We may have reached the point where it would be fair to ask if Bangladesh has squandered the ballyhooed demographic dividend it has been enjoying.

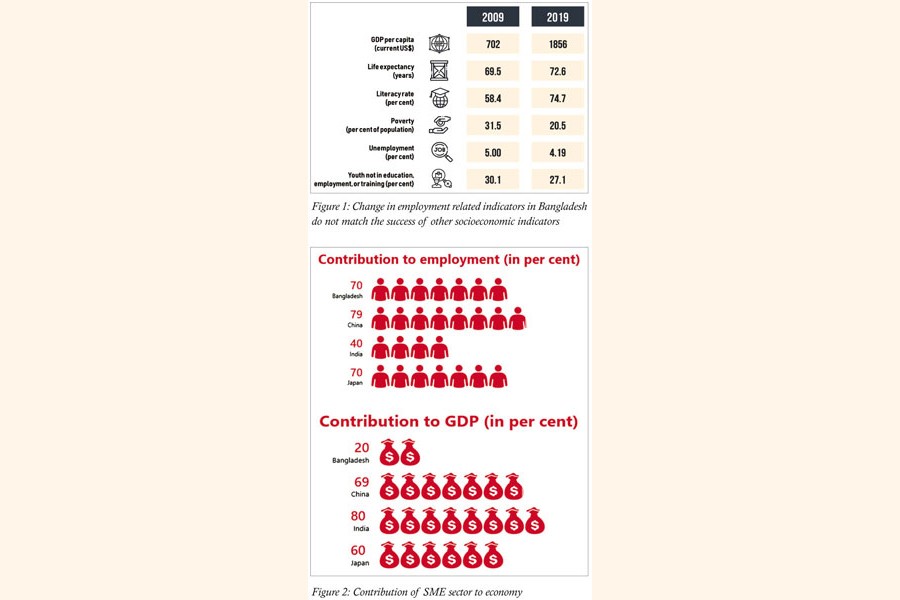

South Korea could be a good role model for Bangladesh in terms of creating employment opportunities. After the Korean War, South Korea was one of the poorest countries of the world with GDP per capita of US$ 79 in 1960, lower than even Bangladesh's GDP per capita income of US$ 89. Today South Korea has a GDP per capita of around US$ 30,000 - more than 15 times Bangladesh's, and the only country in recent memory to transition from a recipient country of development assistance to a significant done. While the emergence of South Korea's famous 'chaebols' or large conglomerates such as Samsung, Hyundai, LG, Doosan, etc. resulted in the economic revolution, South Korea's Small and Medium-sized enterprises (SMEs) provided the backbone for the transformation. SMEs in South Korea represent 99 per cent of enterprises, 89 per cent of total employment and 38 per cent of exports. This is a significant contribution considering the strong presence of local conglomerates and multinational corporations in the country. On average, exports account for more than half (59 per cent) a South Korean SME's total revenue. SMEs play a similarly important role in economies of India, Japan and China. In comparison, Bangladesh's SMEs make a much smaller contribution to the country's GDP. While the sector makes a significant contribution to overall employment, many of the jobs in SME sector are considered underemployment by job seekers.

As the country begins its journey towards achieving the developed nation status by 2041, SMEs need to be uplifted so that the sector can generate quality employment. The sector has been seriously impacted by Covid-19. According to a recent survey by the International Finance Corporation (IFC), 37 per cent of workers employed by the Micro, Small and Medium enterprises (MSME) became unemployed during Covid-19 and 70 per cent of the existing jobs are at risk. Sales revenue declined for 94 per cent of MSMEs and 91 per cent of MSMEs experienced declining cash flow due to sagging demand. It is also telling that only 9.0 per cent of MSMEs used social media and other digital platforms to sustain their business operations. While most of the SMEs have resumed business after the Covid-19-induced general holidays, they are struggling to break even after covering fixed and salary cost of operations.

Against this backdrop, the immediate priority needs to be reversing the decline of the SME sector and provide funding and support for their survival. Even before the pandemic, the sector faced scarcity of funding. To the credit of the government, a stimulus package worth Tk 200 billion has been dedicated to the SME sector. However, by end of September 2020, only about a quarter of the available fund was distributed - a survey by South Asian Network on Economic Modelling (SANEM) found 72 per cent of SMEs not receiving any funding from the stimulus package. The 9.0 per cent lending rate ceiling, high cost of loan administration, unavailability of collateral, higher default risk due to the Covid-19 and the lack of awareness and financial literacy among SMEs has been cited as the reasons for the lack of disbursement. Bangladesh Bank has reportedly served show cause notices for 24 banks and non-bank financial institutions (NBFI) for not disbursing any loans against the package, along with warning for 25 banks and NBFIs for distributing a nominal amount. The central bank has also introduced a credit guarantee scheme (CGS)- under which collateral-free loan between Tk 200,000 and Tk 5,000,000 can be disbursed to the SMEs. The introduction of a CGS will reduce the cost of potential defaults by guaranteeing part of the repayment of SME loans. Public and private CGSs around the world have significantly increased credit access to SMEs around the world. While the CGS may address short-term survival, there needs to be focus on future growth as well.

There needs to be initiatives, both public and private, which will address the long-term challenges that Bangladeshi SMEs have faced as well as the new challenges SMEs will face in the post-Covid landscape. SMEs need help with access to new demand, increasing productivity, adopting with digital and scaling-up. First, many SMEs are unable to participate in public procurement. The government can look into simplifying procurement process and relaxing requirements so that SMEs can participate. The government can also consider extending advance payment to SMEs as part of the credit guarantee scheme. Second, the government can launch a productivity and scale-up programme for SMEs to unlock their potential. The programmes can facilitate SMEs access to financing, networking, consulting, and also provide executive coaching to introduce best practices for enhancing productivity. For example, Morocco's government launched an experience-based training program in 2011 for teaching the latest lean manufacturing principles to SMEs through a model factory. Up to 100 SMEs are enrolled annually for a six-month programme, where representatives of SMEs send a few days each month at the training factory and then go back to their firms to implement what they learned. Finally, there needs to be digital platforms so that even SMEs who lack knowledge of digital technologies and lack access to digital talent can easily adopt digital technology as part of their regular business operations. Bangladeshi start-up ShopUp, which recently raised $22.5 million as Series-A funding, provides small businesses easy access to B2B sourcing, last-mile logistics, digital credit, and business management solutions. Similar platforms are required for SMEs of different sizes and different stages of maturity.

Apart from enhancing the existing SMEs, there should be a focus on the creation of new ventures through promotion of entrepreneurship and entrepreneurial mindset among citizens. Apart from workshops and training for potential entrepreneurs, entrepreneurial skills need to be infused as part of formal curriculum. For example, entrepreneurship is introduced among Polish students at the primary level, and high school students are taught course on the entrepreneurship. Entrepreneurs also need access to start-up hubs where they will be able to launch their businesses with access to an innovative environment and required business support to navigate the administrative requirements for running a business. Such start-hubs can be created by universities in partnership with public and private venture funds. There is also need of modernising bankruptcy laws to protect the entrepreneurs and help them recover from inevitable failures that come with attempts at innovation.

SMEs can be the engine for economic growth and employment generation after the Covid-19 crisis, but it all depends on effective and visionary response by the government - Bangladesh's long-term aspirations depend on it.

Nabid is a senior manager at an international bank, all views are his own.

[email protected]

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.