The Covid-19 pandemic has badly affected economic activities worldwide, and Bangladesh was no exception to the impact. Central banks, as the regulator of financial systems, particularly for the banking systems, faced enormous challenges during the Covid-19 period to support macroeconomic and financial stability. One of the main focuses of Bangladesh Bank (BB) was to ensure adequate credit flow for continuing the country's business and investment activities while keeping in mind that the excess credit flows did not create any inflationary pressure on the economy. As observed during the Covid-19 period, commercial banks, as key market players in the financial sector, were cautious to some extent to provide fresh loans in the face of uncertainty of the forthcoming business condition. The credit growth, particularly the private sector credit growth, slowed significantly during the restricted time in Covid-19 periods even though BB adopted an easy monetary policy amid the government's stimulus packages to circumvent the pandemic effects. The situation has reversed with the appearance of external sector difficulties due to Russia-Ukraine war-induced supply chain disruptions in the post-pandemic recovery periods. Private sector credit growth has started to increase since the third quarter of 2021 and maintained an uptrend until to date (October 2022, the latest available data period).

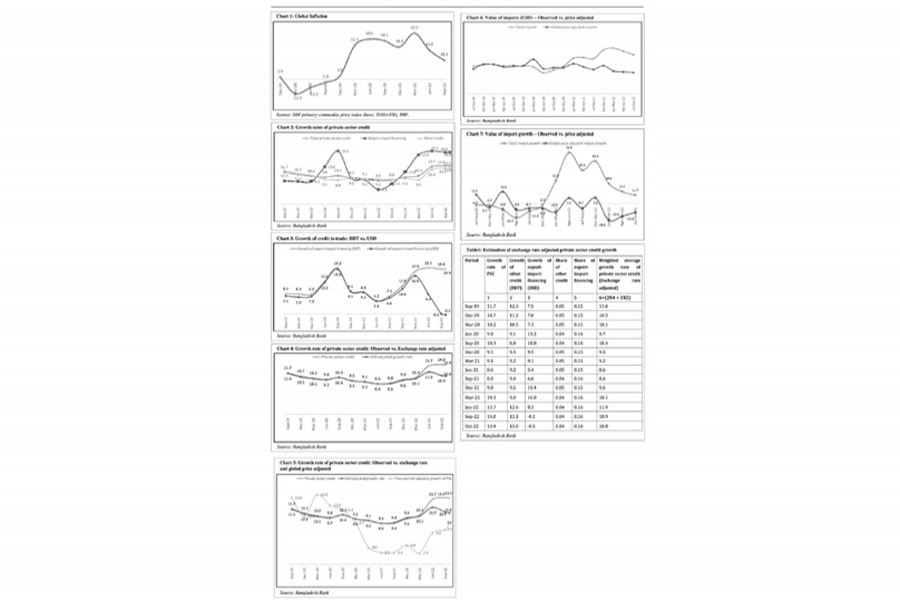

With continued growth-supportive policy measures, Bangladesh's economy successfully recovered from the Covid-19 impact as real Gross Domestic Product (GDP) grew by 6.94 and 7.25 per cent in FY21 and FY22, respectively, reaching the pre-pandemic growth rates. However, when the economy started to gain further growth momentum speeding up its growth recovery, the Russia-Ukraine war came in front as a blow to Bangladesh economy like most other economies. Bangladesh, in fact, started to feel the heat of the war from its external economic sectors, mostly through global commodity price channels. Chart-1 shows that global inflation was very high, close to or above 50 per cent, from March 2021 to June 2022. The inflation decreased in September 2022 but remained very high at 28.3 per cent.

The effects of global commodity price hikes ultimately caused significant increases in import costs for Bangladesh since the first quarter of 2021. Consecutive four quarters of 2021 experienced 32.3, 72.9, 47.6, and 60.5 per cent import growth, which, thereafter, created huge pressure on the exchange rate of Bangladeshi Taka (BDT) against United States Dollar (USD). The nominal exchange rate (BDT/USD) remained mostly stable for a long period. In recent times, however, it exhibited some instabilities reaching BDT 86.20 per USD in March, BDT 93.45 in June, BDT 101.70 in September, and BDT 104.35 in October 2022. Higher import costs originated mainly from the combined effect of commodity price hikes and exchange rate depreciation creating higher demand for domestic credit for export and import businesses. Since private sector credit has been growing recently, it is worthwhile to seek the link between private sector credit growth and external sector instability (exchange rate depreciation and commodity price hike). To this end, this policy note tries to estimate the extent of the contribution of two external sector factors, i.e., exchange rate depreciation and global commodity price hikes, on the observed private sector credit growth in Bangladesh.

PRIVATE SECTOR CREDIT IN BANGLADESH: While the share of export-import financing out of total private sector credit remains almost stable at around 15-16 per cent all through the sample periods during September 2018-October 2022, growth rates of export-import financing exhibited higher variability than that of other credit. Chart-2 shows that credit to export-import financing growth started rising in March 2020 and peaked at 19.3 per cent in September 2020, pulling total private sector credit growth higher. Nevertheless, the growth rate slowed again and dipped to 5.3 per cent in June 2021, reflecting the cyclic effects of Covid-19 pandemic-related lockdowns.

However, private sector credit growth started to improve since September 2021, mainly driven by credit to export-import financing growth as the export-import growth increased gradually and reached close to 20 per cent in recent months. The export-import financing growth contributed significantly to the recent high private sector credit growth phenomenon.

ESTIMATION OF EXCHANGE RATE ADJUSTED PRIVATE SECTOR CREDIT GROWTH: This note estimates exchange rate-adjusted private sector credit growth following several steps. First, total private sector credit is divided into two parts - export-import financing and other credit. Other credit covers the amount of private sector credit other than export-import financing. Then, only the export-import financing is converted into USD terms to remove the BDT-USD exchange rate depreciation effect. Comparing the growth rates of export-import financing between BDT and USD terms, it is evident that the growth of export-import financing in USD sharply declined in recent periods, particularly since March 2022, while the growth of export-import financing in BDT continued an uptrend during the same period, reflecting exchange rate depreciation as a key contributor in the recent high growth of export-import financing (Chart-3).

Using the growth rate of export-import financing in USD terms and that of other credit in BDT, a weighted average growth rate of private-sector credit can be estimated. Here, the share of respective credit is considered to calculate the weighted-average growth rate, which is, in fact, the exchange rate adjusted weighted-average private sector credit growth rate (Table-1). Chart-4 shows that while the observed private sector credit growth rates almost perfectly matched the exchange rate adjusted private sector credit growth rates until March 2022, the exchange rate adjusted growth rate, after that, started to deviate. The observed growth rates were 13.7, 14.0, and 13.9 per cent in June, September, and October 2022, respectively. On the other hand, exchange rate adjusted growth rates were much lower and stood at 11.9, 10.9, and 10.8 per cent in June, September, and October 2022, respectively. Therefore, the recent high growth scenario reflects the result of significant exchange rate depreciation.

ESTIMATION OF EXCHANGE RATE AND GLOBAL PRICE-ADJUSTED PRIVATE SECTOR CREDIT GROWTH: This section does the same exercise as in the previous section but incorporates the impact of global commodity price index inflation in addition to exchange rate adjustment. The global price adjustment factor is calculated based on IMF's Commodity Price Index. The base index is estimated as the average price indices of pre-Covid periods' during September 2018 - December 2019. Using this adjustment factor, the growth of price-adjusted export-import financing is calculated. After that, a weighted average growth rate of private sector credit is estimated, which appears to be further lower than the exchange rate adjusted private sector credit growth. Exchange rate and global price adjusted growth rates were much lower than the observed growth rates after December 2020, which stood at 6.6, 7.3, and 8.8 per cent in June, September, and October 2022, respectively (Chart 5).

GLOBAL COMMODITY PRICE HIKES AND HIGHER IMPORT PAYMENTS: Global commodity price fluctuations have important implications as Bangladesh is a net commodity importer. This note also aims at understanding whether the possible cause of increased import payments is the global commodity price increase. Besides, it also investigates the effects on macro-financial linkages of increased nominal import payments due to global commodity price hikes by exploiting available literature and data.

Firstly, this note considers the real and nominal import payments to understand the global price effect on import payments. The real import payment is defined as the nominal import payment in US dollars deflated by the global commodity price index. An aggregate commodity price index series has been used as a price deflator because imports of different commodities may have different sensitivities to commodity price cycles. Not all commodities' price changes are alike in terms of their potential effects.

The plot of quarterly observations displayed in Chart 6 illustrates the import situation of the country during the recent commodity price cycles. It highlights how the performance of import payments moves with the price cycles. During the low commodity price setting, total real import payments were higher. In comparison, global price-adjusted import payments were significantly lower at the recent high price situation considering the same amount of import.

A visual inspection of Chart-6 reveals a co-movement between the real and nominal import payments up to July-September 2020 of the sample period. From July-September 2019 to July-September 2020, global commodity price inflation stayed in negative territory (Chart-1). Consequently, nominal import payment largely trended downward, which depicted that Bangladesh has benefited from the low price as a commodity importer country. The falling trend quickly reversed after October-December 2020 as the global price picked up sharply and maintained an upward trend till the last timeframe of the sample period. Nevertheless, the real import price remained largely stable until around October-December 2020. Afterward, global price-adjusted import payments trended downward, attributed to the spiral effect of Covid-19 and Russia-Ukraine-induced global commodity supply bottlenecks. Markedly, there was a large gap between nominal and real import payments at that time. Chart-7 also depicts a similar growth pattern for nominal and global price-adjusted imports. It is evident that nominal import growth was significantly higher than the global price-adjusted import growth rate after December 2020. Therefore, the nominal import payments were highly dependent on the commodity prices. An increase in nominal import payment represents a surge in commodity prices and vice versa.

IMPLICATIONS OF GLOBAL PRICE-INDUCED IMPORT PAYMENTS THROUGH THE CREDIT CHANNEL: The large increase in recent global price-induced import payments had several implications in terms of trade, exchange rate, and balance of payments, as well as on the real economy of Bangladesh through bank lending channels. When a smaller volume of imports can be purchased with a given volume of exports may be due to higher commodity prices, it represents the weakening of the country's terms of trade. Consequently, a high association between commodity import prices and terms of trade was apparent. In contrast, shocks to the commodity price were directly transmitted to the terms of trade and subsequently to the exchange rate. The weakening of the country's terms of trade generated a trade deficit and exchange rate depreciation pressure in the face of increasing import payments relative to export income. As a result, for an import-dependent country, a depreciated exchange rate disadvantages domestic customers via higher-priced imports while it favours foreign exchange earners like exporters and wage earner remitters.

KEY FINDINGS AND CHALLENGES: This policy note attempts to estimate the extent of the contribution of the external sector's instability to the private sector credit growth. The note finds that though export-import financing remained around 16 per cent during the sample period, there is a tendency to have higher growth in export-import financing during the period of higher global commodity prices in the presence of relatively stronger USD against BDT. Moreover, export-import financing in terms of BDT vis-à-vis USD grew much faster in recent times, reflecting the costs of exchange rate depreciation against USD.

The note also finds that a huge depreciation of the exchange rate of BDT against USD led to the increase in the private sector credit growth at higher rates in recent periods. Moreover, the calculated weighted average growth rate of exchange rate adjusted private sector credit was much lower than the observed growth rates of private sector credit. Meanwhile, the global price and exchange rate adjusted growth rate became further below the observed growth rate of private sector credit in recent periods. On the other hand, the policy note finds that the global price index adjusted import payments (in USD) appeared to be significantly lower than the unadjusted import payments since July 2022. As a result, global price-adjusted import growth remained much lower than unadjusted import growth.

Overall, adverse commodity price shocks and exchange rate volatility can create challenges to the economy through credit channels which ultimately impact banks' balance sheet. First, a surge in import payments compared to that of export earnings leads to an increase in bank credit to the trade, which may create a potential liquidity mismatch. Second, the shocks could unfavourably impact economic activity and agents' (including the government) ability to meet their debt obligations, thereby potentially deteriorating banks' balance sheets.

Large commodity price shocks can also affect banks' balance sheets by weighing on a country's reserves and increasing the risk of currency mismatches. Third, a sharp increase in global commodity prices can impact commodity importers' budgetary balance, which may drive the government to adjust its budget to contain any such budgetary imbalance. In view of tackling external factors-driven imported inflation, there are not many policy options available other than making appropriate supply side interventions. Managing the exchange rate adversities requires market oriented flexibility.

The article is based on a policy note prepared by Dr Md Habibur Rahman, Chief Economist, Dr Md Salim Al Mamun, Additional Director, and Ms Nasrin Akter Lubna, Deputy Director, Chief Economist's Unit in Bangladesh Bank.