Multinationals operating in Bangladesh are reinvesting funds here as repatriation of their profits and royalties stalls amid dollar shortages, sources said about one of major economic problems stemming from the current crisis.

They also said release of some freight of the multinational companies or MNCs also faced the same dilemma, especially in import cases, as the local part pays out in dollar to foreign vessels

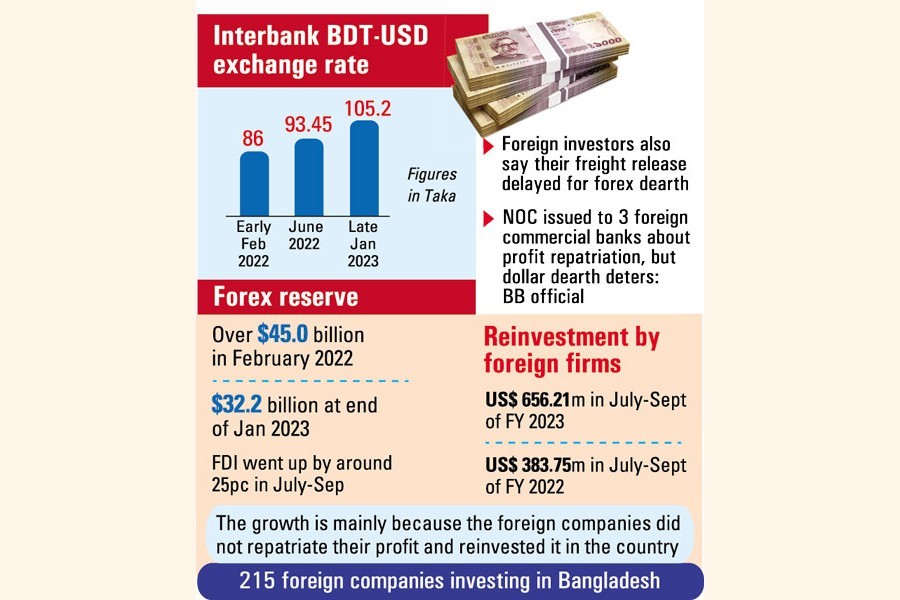

Contacted for a clear view of the situation, a central bank official told the FE that the inflow of net foreign direct investment (FDI) had gone up by around 25 per cent in the first quarter (July-September) of the ongoing fiscal year in comparison with the same period of last fiscal, propelled by such reinvestment.

"The growth is mainly because the foreign companies operating here did not repatriate their profits and reinvested in the country," the Bangladesh Bank official said, asking not to be named.

He pointed out that reinvestment of earnings had a huge jump there. The MNCs can have many options to invest the amount meant for profits, dividends, HQ costs, and others in Bangladesh. But after receiving interest on fixed deposit, they cannot send the additional earnings to their foreign counterparts.

According to the latest data with the central bank, the volume of reinvested earnings by branches of the foreign firms operating here was US$ 656.21 million in the Q1 of this fiscal which is 71-per cent higher than US$ 383.75 million earned in the same period of time in the previous financial year.

As per the BB regulation, a foreign company's branch needs no prior approval of the central bank in repatriating profits amounting to US$10 million. But it will need BB's no-objection certificate (NoC) if it crosses the cap.

The BB official also informed that they had already issued NoC to three foreign commercial banks (FCBs) regarding the repatriation of profits.

"But the banks have not been able to do it yet because of unavailability of the dollar," the official said, without disclosing the names of the banks.

President of Foreign Investors' Chamber of Commerce & Industry (FICCI) Naser Ezaz Bijoy said the branch offices of foreign companies were facing problems in repatriating profits and royalties to their head offices due to the ongoing USD liquidity tightness.

Mr Bijoy, also chief executive officer (CEO) of Standard Chartered Bank, Bangladesh, said settlement of LCs is the bank's top priority followed by government-guaranteed loans and airline remittance.

He said dividend remittance and royalty is the fourth area of the priorities. As the overall macroeconomic situation is under pressure for various external factors, the bank tries to serve the clients based on priorities.

"Even, we (standard chartered bank) did not send dividends to our head office from 2021 considering foreign-currency obligations of our clients," he said.

The top executive of the local operations of the London-based global lender said they were considering an alternative to the foreign companies who have urgency to send back dividend remittance and royalties.

"If any overseas firm has such urgency and the central bank allows, we can facilitate such entities by providing loans in foreign currencies to meet their emergency obligation. Once the dollar situation improves, we'll adjust those," he says about a swap.

On a note of optimism, the FICCI president said the average monthly import orders were equivalent to US$ 8.50 billion in the first two months of 2022, which came down between US$4.0 billion and US$5.0 billion in later parts of the immediate-past calendar year.

On the other hand, the earnings from exports and remittances are continuously growing. "If we can maintain this trend by intensifying the monitoring activities against informal channels of remittance, things will start to ease from June next. We hope the activities regarding the repatriation of dividends will get a pace," Mr Bijoy hopes.

Contacted, managing director of Berger Paints, Bangladesh Rupali Chowdhury said the problem is created because of a shortfall of the greenback under the changed macroeconomic orders globally.

"We have to absorb the pains hopefully for a certain period of time because it is created by external factors," she said.

Citing the BB governor, Mrs Chowdhury, former president of the foreign investors' chamber of commerce and industry, said the governor told them that things would start to ease from June next as BB is expecting that the economy will rebound later this fiscal with rise in the dollar reserves significantly.

Captain AS Chowdhury, country head of Seaconsortium, a Singapore-based feeder service operator which provides services on Chattogram-Singapore and Chattogram-Colombo routes, told the FE that they had been facing troubles sending some profits to its HQ.

"The foreign-exchange branch is taking time--and this is now almost one year," Captain Chowdhury said.

A total of 215 foreign companies under FICCI operating in Bangladesh belong to 35 nations. They have been operating in 21 sectors, both in manufacturing and services, contributing 30 per cent of resources to the government.

Bangladesh has been facing volatility in its forex market since the middle of last year as a result of the war in Ukraine since February.

The interbank taka-dollar exchange rate (average) was Tk 86 during the first week of February last year. It soared nearly 9.0 per cent to Tk 93.45 in June and shot over 12 per cent up to Tk 105.2 at the end of January 2023 from the June high.

The volatility impacted the country's foreign-exchange reserves as that dropped to $32.2 billion at the end of January 2023--down by more than $13.0 billion in a year from February 2022.

The central bank of Bangladesh tightened imports through a number of measures, including raising the LC margins, to contain the depletion of the foreign-exchange reserves.