Sonali’s Tk 5.0b fund injection boosts investors’ mood

FE Report | Thursday, 11 November 2021

Sonali Bank has provided Tk 5.0 billion to Investment Corporation of Bangladesh (ICB) to invest in the stock market.

Md. Mazibur Rahman, deputy managing director said, Sonali Bank took the move as it has been playing an important role in the capital market by financing its own subsidiary Sonali Investment as well as the state-owned ICB from time to time.

Meanwhile, stocks witnessed a big jump on Wednesday, extending the winning streak for the second straight session, as buoyant investors put fresh bets on major sector shares amid high expectations.

The market opened sharply higher and the upbeat trend continued till the end of the session, finally ending more than 114 points higher.

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), soared 114.09 points or 1.66 per cent to settle at 6,982.

The core index recovered about 183 points in the past two consecutive sessions after losing 568 points in a month from its recent peak.

Two other indices also closed higher with the DS30 index, comprising blue chips, soaring 44.71 points to finish at 2,660 and the DSE Shariah Index rose 24.08 points to end at 1,478.

Turnover stood at Tk 11.63 billion on the country's premier bourse, which was 15.50 per cent higher than the previous day's six months lowest turnover of Tk 10.07 billion.

"As the index lost over 500 points in the last one month, investors opted to take new positions in the stocks in the last two sessions in what they deemed to be lucrative price levels," commented EBL Securities.

Market insiders said backed by lucrative prices and price spiral in some specific large-cap stocks added a boost to overall market movement.

"The benchmark index saw sharp gain as investors started to feel the market to be at an oversold territory," according to a merchant banker.

Support from institutional investors, including state-run ICB, has boosted the confidence of general investors, he said.

"Investors hope that the market will soar further, so they are pouring in their money," he said.

The large-cap stocks such as ICB, Walton, Square Pharma, LafargeHolcim and BATBC led the market rally, said a stockbroker.

"Some high-profile companies are still lucrative to invest in, while most of the low-profile companies' shares turned into overpriced," he said.

The investors' enthusiasm in financial institutions, cement, ceramic and textile sectors helped the DSEX stay upbeat, it said.

Major sectors posted gains with financial institutions generating the highest gain of 4.30 per cent, followed by cement with 2.80 per cent, textile 2.70 per cent, pharma 1.60 per cent, engineering 1.60 per cent, banking 0.70 per cent and telecom 0.40 per cent.

More than 80 per cent of traded shares closed higher, as out of 375 issues traded, 301 ended higher and 43 lower while 31 remained unchanged on the DSE trading floor.

A total number of 171,638 trades were executed in the day's trading session with a trading volume of 242.31 million shares and mutual fund units.

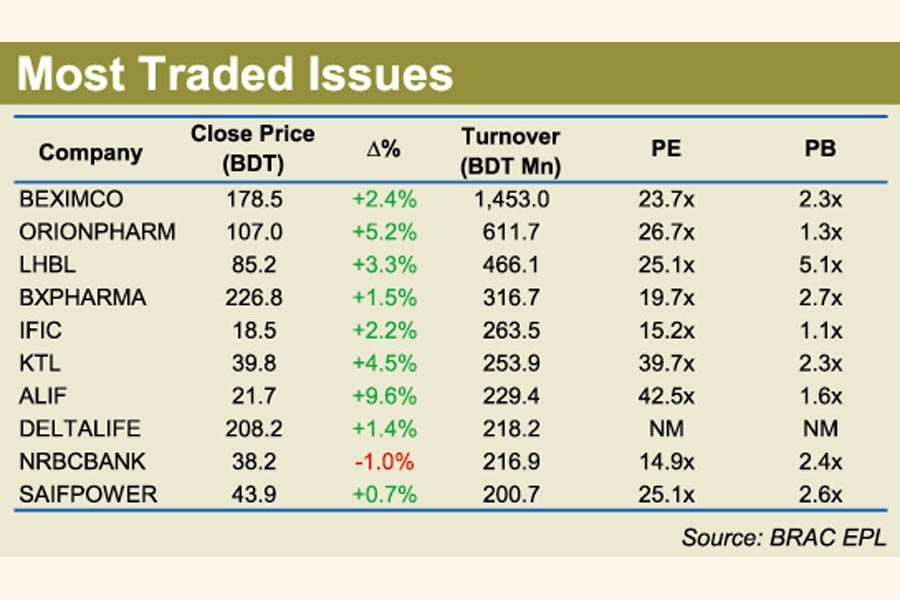

Beximco - the flagship company of Beximco Group- topped the turnover chart with shares worth Tk 1.45 billion changing hands, followed by Orion Pharma (Tk 611 million), LafargeHolcim (Tk 466 million), Beximco Pharma (Tk 316 million) and IFIC Bank (Tk 263 million).

The Chittagong Stock Exchange also ended sharply higher with its All Shares Price Index (CASPI)-soaring 336 points to close at 20,434 while the Selective Categories Index - CSCX - rising 202 points to close at 12,278.

Of the issues traded, 228 advanced, 30 declined and 24 issues remained unchanged on the CSE.