Cottage, Micro, Small & Medium industries and the agricultural products play an important role in achieving the recognition of Bangladesh as a developing country. The development of the SME industry is considered more seriously, as a result of which Bangladesh Bank provided easy terms and financial services to aid flourishment of the SME sector. Since 2010, BB provided various financial services and implemented awareness programs through state -owned banks and also private commercial banks under Dr. Atiur Rahman, former governor, and Mr. Fazle Kabir, the incumbent governor. So the SME sector thrived in Bangladesh in the last one decade. A total of 6.0 million business entrepreneurs are now running SMEs across the country.

There are several reasons for the emphasis on the SME sector. One of the main reasons is employment generation. The literacy rate is increasing day by day in Bangladesh but the rate of employment is not increasing in tandem with the efficiency. Besides, all entrepreneurs haven't the ability to invest in heavy industries. So, the development of small and medium enterprises will not only increase the number of entrepreneurs, but also create jobs for the unemployed people. It will also help build a poverty-free Bangladesh.

Premier Bank is facilitating the development of the Cottage, Micro, Small & Medium enterprises and in the agriculture sector since its inception in 1999. The Premier Bank believes that SME enterprises are the main engine of economic development and the major source of employment generation in a country like Bangladesh. To promote the growth of the country's SME businesses and agriculture sector, Premier Bank established a separate division for the SME and Agriculture Banking in 2009 with 12 dedicated SME and Agriculture branches.

Bangladesh is the 39th largest country in the world in nominal terms and 29th largest country in terms of PPP and 3rd fastest growing country all over the world. At present contribution of SME to GDP growth of Bangladesh is 25%, whereas in India, Singapore and Malaysia it is 40% - 50%. There is a huge scope for SMEs to contribute more profusely to GDP growth of Bangladesh.

However, because of supervision of the senior management of Premier Bank, SME loan distribution has gradually increased from 2016; the bank has already distributed 35% of the total credit portfolio in the SME sector. According to the business plan, 50% of the total credit portfolio has been set up for the SME sector by 2024, whereas the Bangladesh Bank policy stipulates 25% as per Bangladesh Bank vision of 2024.

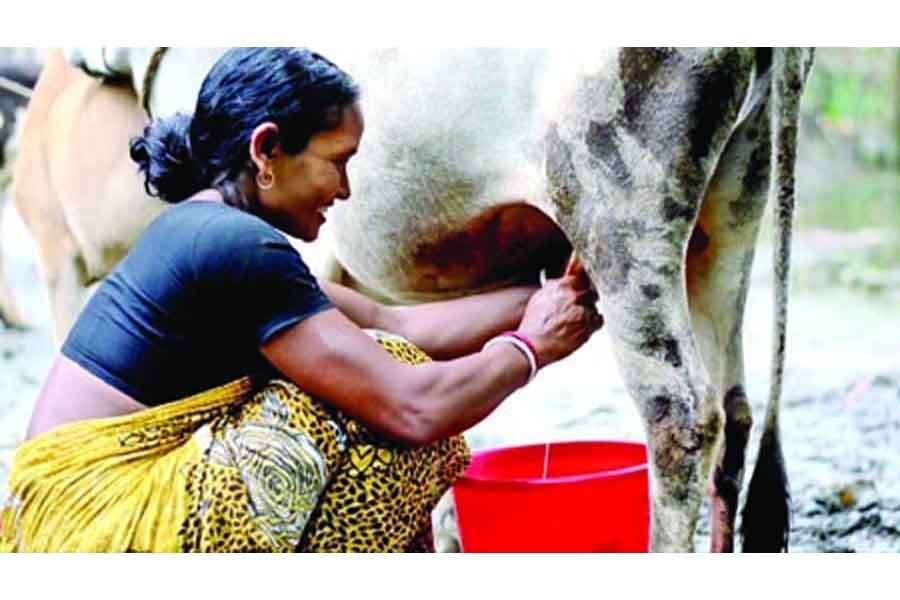

To build a poverty-free Bangladesh and ensure more employment generation, the Premier Bank has also put thrust on the support of underprivileged rural citizens and farmers (10/- Taka account holders) of Bangladesh by providing easy loan facilities to increase their income generating activities all over the country.

To meet the diverse and evolving needs of SME businesses, Premier Bank has designed various deposit & loan products as per the requirement of SME & Agriculture Clients. The bank also offers some unique loan products namely "Premier Grameen Swnirvor", "Premier Samridhi", "Premier Quick Trade" and "Premier e-GP Finance" to support entrepreneurs belonging to micro and cottage segment, agriculture sector, export-import business segment and infrastructure development of Bangladesh.

Considering the market scenario of Bangladesh's economy, The Premier Bank Ltd. SME & Agriculture Banking division has key business focus areas among the CMSME business which are as follows:

- e-GP Business

- Work Order Finance

- SME Term Loan

- SME Trade Finance

- Micro & Cottage Finance

- Agriculture & Rural Finance

Premier Bank has realised that the importance of the SME sector is very much for bank's sustainable business growth as well as for the growth of Bangladesh's economy. That is why our bank's business focus is 50% in SME business, 35% in RMG business and 15% in retail business. Premier Bank always concentrates to contribute to GDP growth of Bangladesh rather than Bank's profit.

In this context, The Premier Bank has been honoured with the prestigious international award of "Fastest Growing SME Bank in Bangladesh 2018" by International Finance UK. As per our vision 2024, Premier Bank will be renamed as "SME Bank" in Bangladesh.

The writer is EVP & Head of SME & Agriculture Banking Division of The Premier Bank Limited.