Remittance and ready-made garments (RMG) are the two economic engines that have pushed Bangladesh through numerous challenges in last few decades. Agriculture had been and still is a major source of economic revenue for Bangladesh. However, in the context of current digital world, the value added services (VAS) for Bangladesh's economy can be attributed to RMG and remittance-generating sectors. Private sector and government should prioritise using Mobile Financial Services (MFS) to increase financial inclusion as well as inflow of foreign remittance. In reality, given Bangladesh's regulatory and systemic weaknesses digital hundi (illegal money transfer through digital means) will continue to happen. It is in government's own advantage to assertively initiate joint ventures with experienced Money Transfer Operators (MTOs) with experience in anti-money laundering (AML) and encourage its 10 million migrant workers abroad to use such services

Bangladesh's dynamic growth have both horizontally and vertically benefitted through RMG sector's exposure to international trading from marketing strategy to negotiation, globally-mandated compliance procedures and competing with global companies. While close to 10 million migrant workers contributed to the economy and continually increased the country's foreign exchange reserve, the import bill for the RMG and other manufacturing sectors benefitted from such healthy reserve. This guaranteed a positive current account for the country. However, still most of the RMG workers are out of the formal banking system. An initiative called "The Sarathi Project" aims to disburse salary of workers of 60 RMG factories through opening bank accounts for them. Similar initiative with MFS and agent banking through state-owned banks (SoBs) will be a much-needed public service for the country's unbanked.

Government should pursue innovative solution which to not challenge what MFS has to offer. Rather it needs to facilitate using it to link its remittance inflow through proper channel. Most of the migrant workers are in the government database and with region-specific MTOs' expertise. A secured and cost-effective MFS for remittance can be launched as a test case. Migrant workers in several countries now can send money to their families' bKash accounts because of joint collaboration between bKash and Transfast Remittence LLC, Index etc. Brac Bank, Mutual Trust Bank and Bank Asia are local banking partners in this process.

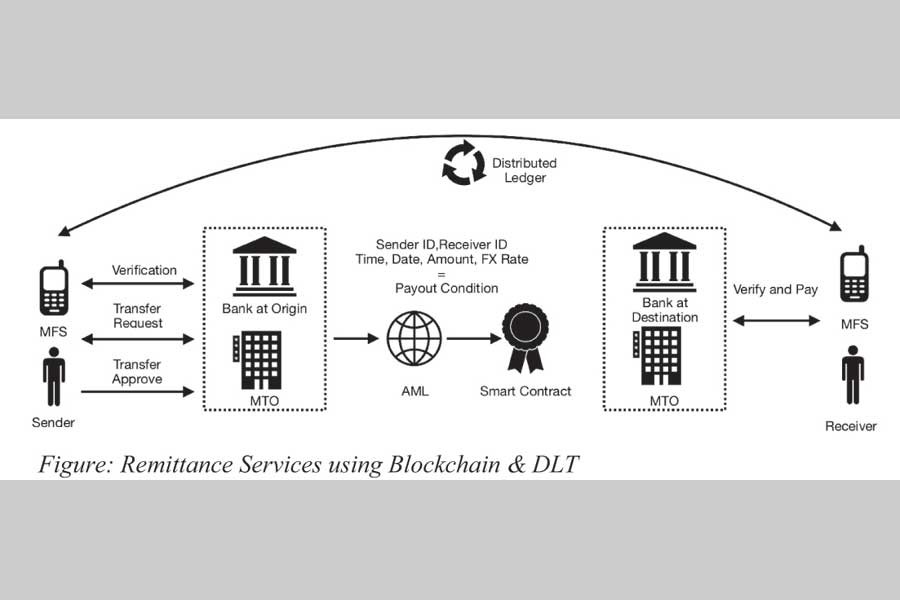

Government and current remittance-service providers should initiate the next evolutionary step in remittance transfer - person-to-person, internationally, through MFS. There have already been pilot programmes testing the above process using the technology behind cryptocurrency - blockchain and DLT (Distributed Ledger Technology). Existing banks, already partnered with such services, can join the new MFS system. The DLT and blockchain together create a pay-out condition and a "Smart Contract" synched with these individual processes, honouring the remittance transfer. Smart Contract is a digital protocol that conducts verification, facilitation and enforces payment; it works as a digital escrow service.

The system should be designed for fiat currency although using the technology from the crypto world.

Recently after a new directive from Bangladesh Bank mandating one MFS account to be linked to a single NID, the total MFS account number dropped from 30.73 million to 20.26 million. These are necessary reforms whereas limiting transaction limits to restrict money-laundering is like punishing almost everyone for the wrongdoings of the few. If Bangladesh Bank truly wants to curtail large-scale money laundering, then it needs to focus on its core function of ensuring sound banking sector management, auditing under-and-over-invoicing and scrutinising fraudulent loans that becomes NPLs (non-performing loans).

Government should focus on supporting both private sector and joint ventures which use the advantages offered by internet and smart-phone technology to launch new financial inclusion programmes. The workers in the RMG sector may be integrated into retail banking system through mobile banking; they can receive their salary and send fund to families through services like bKash which will be connected to their respective bank. The private sector banks (PCBs) can follow the example of Venmo and Zelle from the US. It is a single platform that interconnects major commercial banks to facilitate money transfer between account holders. The young professionals and urban residents would be the easy recruit and beneficiary but we have to remember how the whole Bangladesh society aggressively adopted the cell-phone technology even though it was at first marketed only for the urban residents and business elite.

Paypal, Google Wallet and cryptocurrency wallets have tried to become mainstream and in some countries and specific age-groups, they have captured loyal users. However, the person-to-person and person-to-vendor transaction still required a banking intermediary. Paypal, Google Wallet, credit cards are yet linked to a bank account. After much experimentation the US banks realised that they should join forces and provide platforms that interconnects banks and their accounts holders through smart phones and internet in order to maintain their leverage with consumers. These phenomena can be analysed to find the learning curves just like the early days of mobile-payment systems in Africa. The US, Europe, Japan, South Korea had the infrastructure to launch mobile-payment systems but it was in Africa it gained traction. The systemic weaknesses made such tech-based monetary solutions attractive and practical. In the developed countries the monetary system was transparent, fast and already available; hence the incentive to raise public support and gain clientele was low.

Now, if all the RMG workers and similar industrial workers in Bangladesh are given the option to have mobile bank accounts, then it would have an enormous positive effect. Use of blockchain and DLT will not only facilitate disbursement of salary but also help labour unions, workers' right organisations, National Board of Revenue (NBR) in implementing policies and widening tax collection. The World Bank has already observed that financial inclusion for rural women in Bangladesh is primarily associated with female RMG workers. This shows that the ability to make economic decision without the principal-agent problem is a huge incentive for unbanked people.

The recent bKash-Alipay deal is an insight into what is valuable in this new age of digitally connected world. Given Bangladesh's context, data is the scarcest commodity and reliable data is the holy grail. bKash has the aggregated data that truly captures the monetary-transactional neutral network of the whole country. This is a necessary element to design and build Bangladesh-centric adaptive FinTech and e-commerce platform. Alipay, bKash, Transfast and similar collaborations are all focused on providing basic financial services in real-time through resilient back-end solution.

bKash not only has shown that using Bangladesh's existing social-infrastructural an operation of payment system can be scaled up to meet demand. It did not need ATM (automated teller machines), rather it used more than 120,000 human agents as ATMs. Starting in 2011, and by 2017 there were more than 24 million bKash account holders, more than the number of people who hold accounts in the formal banking channel in Bangladesh. These are experimental and risky steps but evidence-based and unless other financial institutions and government step up, then they will phase out; the survival of the fittest applies aptly to this era of information and FinTech. If government fails to design services for the masses, then people will seek out the entity that does. It is now for the government to recognise the play and step up.

The writer is Archer Fellow Lee Kuan Yew Scholar