Phased lifting of the rate cap on lending is among some key remedies the World Bank prefers for its engagement with Bangladesh's capital-market development under a major recipe, sources say.

The multilateral development financier feels that interest-rate caps pose roadblocks to advances of both the banking sector and the capital market.

Following a spot check of the current affairs in the country's financial field, the World Bank Group (WBG) has conveyed such message about its possible involvement with the Bangladesh Joint Capital Market Development (JCAP) programme.

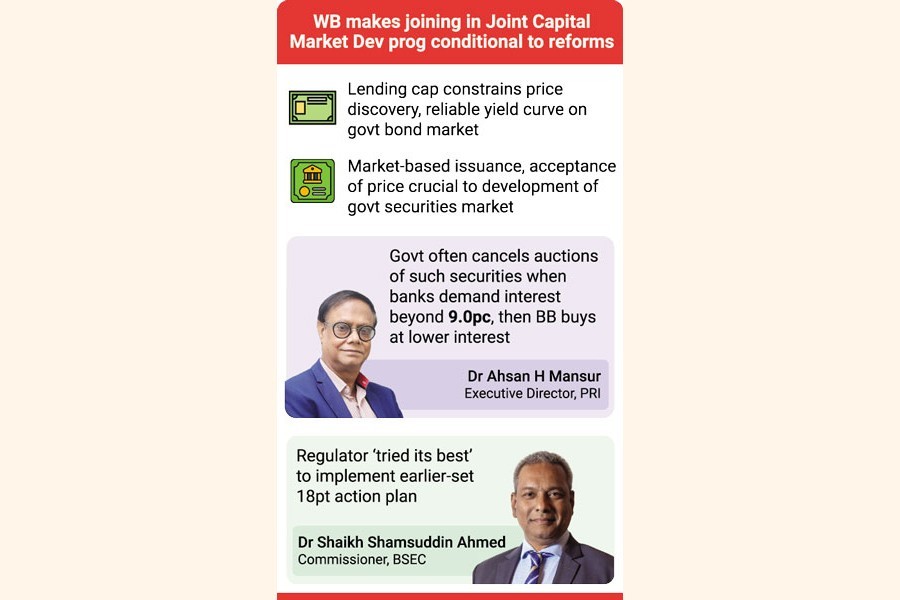

It points out three key factors, including the existing 9.0-percent lending cap, which are hindering development of the country's capital market and banking sector as well.

The other major hindrances are the current framework for the issuance of state-run savings certificates and the absence of a reliable yield curve on the primary and secondary markets.

The WBG thinks the lending cap constrains the price discovery and the formulation of a reliable yield curve on the government bond market.

As such, the WBG has suggested a review of such provisions and reconstituting the committee on long-term finance-and capital-market development.

"Without addressing these key impediments, the value of the work to develop capital markets remains severely constrained, which adversely affects WBG's future engagement under the Bangladesh Joint Capital Market Development (JCAP) Programme," the WBG said in a letter recently sent to the Economic Relations Division (ERD).

It sees a gradual withdrawal of the lending-rate cap as 'critically' important.

Dr Shaikh Shamsuddin Ahmed, a commissioner of the Bangladesh Securities and Exchange Commission, says the WBG is providing technical assistance in framing rules for new products alongside facilitating staff training.

He says the securities regulator tried its best to implement an 18-point action plan earlier set by the World Bank Group.

"We further will try work in line with WBG's suggestions if these are helpful to development of the capital market," Mr. Ahmed says.

He points out that many stakeholders have involvement in the project initiated for the capital-market development. "The securities regulator had no connection behind the measures such as lending-rate cap and savings certificates."

Another top BSEC official says apart from the WBG, the International Monetary Fund applauded the regulator's role in diversifying the capital market.

Asked, an official concerned of the ERD refrained from speaking about the issue.

The banks have been maintaining 9.0-percent interest rate on all loans, other than credit cards, since April 2020 as per government decision under a package measure aimed at navigating a crisis time.

"This lending-rate cap has been overarching (and growing) and has a distortionary effect on the banking sector and capital market," the letter to the ERD reads.

The 'overarching' constraints to the capital-market development have been mentioned by the WBG team which earlier had a series of meetings with the securities regulator, the central bank and other stakeholders.

The mission said interest cap was initially imposed on bank loans and investments, and the same cap effectively applied to investment returns for securities -- bond or sukuk -- also issued by any non-financial organisations.

Dr Ahsan H Mansur, executive director at the Policy Research Institute (PRI), told the FE that banks always want to purchase the treasury bonds at an interest rate that will ensure their profit.

"But the government often cancels auctions of such securities when banks demand interest at over 9.0-percent rate and then the central bank purchases the securities at lower interest rates."

This system is not supportive of the growth of the bond market. Mr. Mansur also says the capital market would be affected if the bond market is affected.

"The banks are also listed on the stock exchanges. If the profits of the banks are hampered by the lending-rate cap, the capital market will bear the resultant impacts," he says about the domino effect of banking situation.

The WBG mission opines that market-based issuance and acceptance of the market price are crucial to the development of the government securities market.

"…the lending cap even constrains the price discovery and the formulation of a reliable reference yield curve on the government bond market," it said during the interactions.

It also said amid rising inflation and the state of yield on government securities, the interest cap became a major impediment to capital-market development.

The inflation rate was 7.5 per cent in July 2022 while the yield on government securities was 8.1 per cent for 10-year government bonds at the end of September 2022.

Md Moniruzzaman, managing director of IDLC Investments, says all asset- class valuations are changed due to the lending-rate cap. "That's why the real picture of assets is not reflected from the valuation of a stock."

The WBG mission had said the current yield curve could not be considered reliable as the price discovery does not work on the primary or secondary market.

"The interest rates on the primary market are administered and a full price discovery does not work in the absence of market-based issuance," said the team during the spot inspections of the capital market.

Despite a decent growth, the capital market cannot reap all the benefits of the repo market as it is not a true repo (repurchase agreement) according to the current practice, according to the WBG team.

"The development of a true repo market would have many advantages for the development of the capital markets and financial stability," it pointed out.

It also said the true repo market have advantages in stronger risk mitigation, support for market makers and improved liquidity of the secondary market of government bonds and enhanced financial stability by moving away from unsecured lending.

The WBG termed the approval for the Debt Securities Rules by the BSEC a good step, though several gaps remain to be addressed.