Titas Gas Transmission & Distribution Company has reported operating losses for the July-September quarter of FY23 for the first time since it was listed with the stock market in 2008, mainly for a sharp cut in the distribution charge.

Bangladesh Energy Regulatory Commission (BERC) in June set the distribution charge at Tk 0.13 per cubic metre gas, down from Tk 0.25, leading to Titas's operating loss of Tk 216 million for the quarter.

About 96 per cent of Titas Gas's revenue comes from distribution charges.

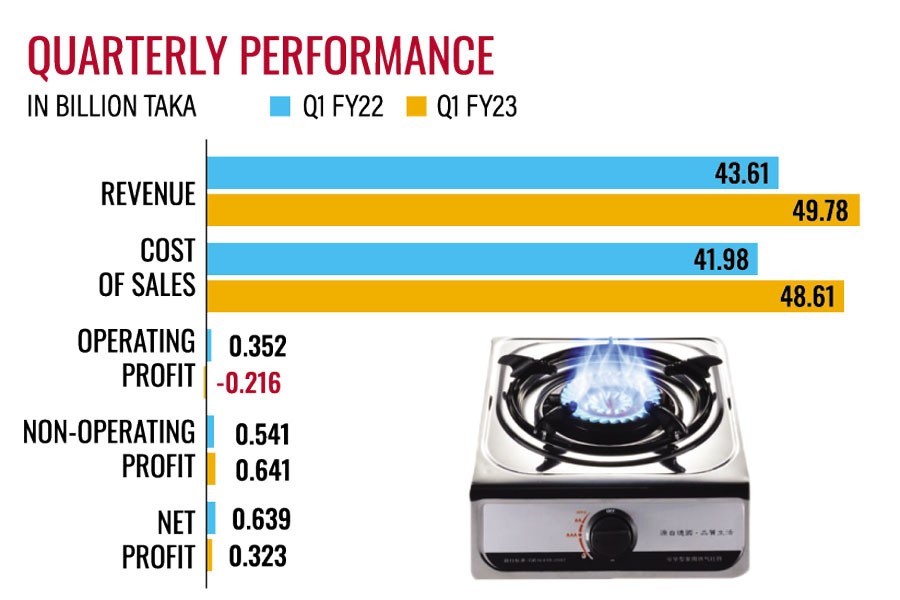

However, its non-operating income rose 18.5 per cent year-on-year to Tk 641 million during the period, salvaging the company from going into the red.

The net profit was reduced to half of what Titas earned in the same quarter of the previous fiscal year. As a result, earnings per share declined to Tk 0.33 for the first quarter of FY23 from Tk 0.65 a year ago.

The reduction in the distribution charge was a fresh blow to the state-run entity as its profit margin had already been narrowed down, said Mostaque Ahmed Sadeque, former president of the DSE Brokers Association (DBA) of Bangladesh.

The company's revenue grew 14 per cent year-on-year to Tk 49.78 billion between July and September this year. At the same time, the cost of sales jumped 15.79 per cent to Tk 48.61 billion, according to the company's un-audited financial statement.

The net profit dropped as the regulatory commission re-fixed the distribution charge, said company Secretary Md Lutful Hyder Masum.

The BERC, on the other hand, increased Titas's charge for bulk gas transmission services to Tk 0.4778 per cubic metre from the previous rate of Tk 0.4235.

Analysts say the increased transmission charge barely benefitted Titas as its transmission business brings not even 0.20 per cent of the company's total income.

The energy regulator cut down the distribution charge, instead of raising it to the previous four years' weighted average of Tk 0.55 per cubic metre as requested by Titas, said a merchant banker, asking not to be named.

The outcome will have a negatively impact on the stock price and dividends to shareholders, he said.

Titas Gas paid good dividends since the listing nearly one and a half decades ago. It has enjoyed a monopoly business. Besides, a fixed profit margin and decent share price made the stock lucrative for foreign investors, said the merchant banker.

But, since 2016 the BERC began lowering the charges for Titas, which analysts and experts did not find justified.

Foreign investors responded by selling off Titas shares. Their confidence in the listed state-owned enterprises is yet to be restored.

The stockbrokers, especially those who provide brokerage services to overseas investors, sold off a bulk amount of shares from foreigners' portfolios, driving down foreign investment from more than 18 per cent to 0.62 per cent in September last year. The stake went further down to 0.18 per cent as of October 31 this year.

Titas's stock remained stuck at the floor -- at Tk 40.90-- since October 13. The share price reached its peak at little more than Tk 127 in 2010 and hit the bottom at less than Tk 30 in early 2020.

Titas Gas's net profit dropped 8.28 per cent year-on-year to Tk 3.17 billion in the fiscal year 2021-22. It declared 10 per cent cash dividend for the year, the lowest since 2010, according to the DSE website.

Established in 1964, Titas Gas collects the total end-user price from its customers against gas supplied and reimburses money for other components of the gas price to the related parties, including Petrobangla, keeping with itself the distribution charge only.