Pharma Aids, the pioneer ampoules manufacturer in Bangladesh, has reported a 31 per cent decline in profit in the fiscal 2021-22, compared to the previous fiscal year, mainly for deferred tax expenses.

It made a profit of Tk 34.75 million in FY22 ended in June, bringing down earnings per share to Tk 11.14 from Tk 16.11 a year earlier.

Apart from deferred tax expenses, there were bad debt expenses, changes in the accounting estimates tied to gratuity, and write-off of an unsettled VAT case shown as an asset in prior years, which dragged the profit down, according to a filing with the Dhaka Stock Exchange on Thursday.

Despite the negative growth in profit, the company's board recommended 50 per cent cash dividend for FY22 in continuation of what it provided for the previous four fiscal years.

The company has also reported net asset value per share of Tk 98.83, decreased from Tk 93.26, and net operating cash flow per share of Tk 10.85, reduced from Tk 10.07, between FY22 and FY21.

Listed in 1987, the stock of Pharma Aids closed at Tk 790.70 on Thursday, without any movement from the day earlier on the Dhaka Stock Exchange.

The company's paid-up capital is Tk 31.20 million, authorized capital is Tk 50 million and the total number of shares 3.12 million.

As of October 31 this year, sponsor-directors own 23.59 per cent stake in the company, institutes 15.91 per cent and individual investors 60.50 per cent.

Having started commercial operation in 1984, Pharma Aids is in manufacturing of the highest quality of neutral glass ampoules for the pharma industry.

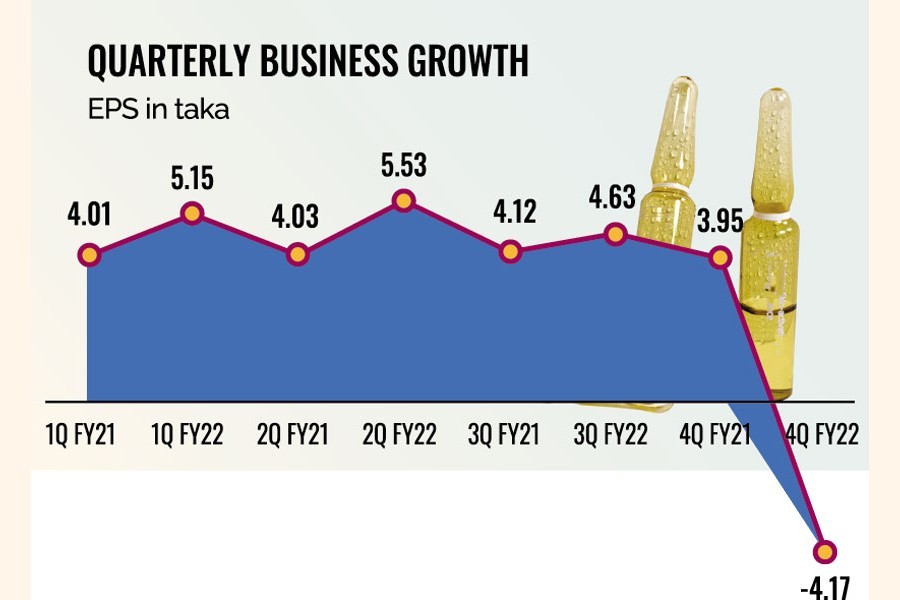

The pharmaceutical sector as a whole has seen its profit grow steadily in the last few years, riding on a jump in sales, launching of new drugs and stronger marketing strategies.

Among the major drug makers listed on the capital market, profits of Square Pharmaceuticals, Renata, ACI, Acme Laboratories, Beximco Pharma, IBN Sina, Beacon Pharma, and Navana Pharma rose between 1.40 per cent and 35 per cent year-on-year in FY 2022.

But their profit growth and handsome dividend declarations were not reflected in their performance in the capital market as the stocks have remained stuck at 'floor prices' in the last few weeks.