IMF finds absence of effective banking supervision, BB uncomfortable publishing report

SYFUL ISLAM | Saturday, 28 November 2020

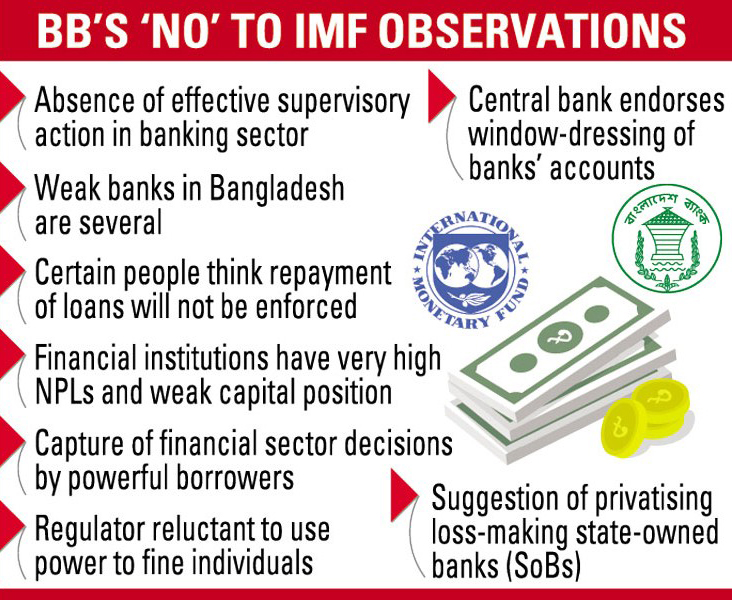

The Bangladesh Bank (BB) has expressed its serious reservation about the several observations made by the International Monetary Fund (IMF) in its Financial Sector Stability Review (FSSR) report.

The report has highlighted the current state of the country's banking sector and the regulatory environment.

The central bank found 'scores' of information given in the IMF report are not 'publishable', and can be made public only after proper 'modification and correction'.

The IMF wants to publish the report on its website with the endorsement of the Bangladesh government. With this end in view, it has sent a copy of the report to the Ministry of Finance seeking comments.

In the executive summary of the report, the IMF mentioned "the absence of effective supervisory action" in the banking sector, which the BB found 'not-publishable'.

While the IMF in the report said the number of weak banks in Bangladesh is several, the central bank has claimed that "taking into consideration the total number of banks, the number of weak banks is not too many."

The central bank also disagreed with a sentence - "… certain well-connected and affluent business people have understood that repayment of their loans will not be enforced."

"It is not a fact that financial institutions have very high NPLs (non-performing loans) and weak capital position. Indeed only a few financial institutions suffer from high NPLs and weak capital position," the BB claimed.

"This type of statement may convey a distorted picture to the readers," the central bank mentioned.

The money market regulator also differed with another observation that said, "There seems to be capture of financial sector decisions by powerful borrowers in Bangladesh."

The IMF, referring to a single indicator of a period, noted that Bangladesh's loan growth has slowed down in 2018.

On the contrary, the central bank said such way of description may wrongly present the financial system as vulnerable, and tarnish the country's image.

The BB strongly disagreed with another sentence that said the regulator has been reluctant to use its power to impose fines on individuals for violation of regulatory rules and regulations.

The IMF also said the central bank endorses window-dressing of accounts of the banks. The BB has also strongly objected to the observation and said it is not publishable.

The central bank differed with a suggestion of privatising the loss-making state-owned banks (SoBs), saying these banks implement social safety net programmes of the government and also extend loans to priority sectors of the economy, including agriculture and agro-based industries.

The IMF further said the generous rescheduling terms, given to large delinquent borrowers in August 2019, is perceived as rewarding non-compliance with commitments, thus undermining credit discipline throughout the overall economy.

The BB differed with the observation, saying the rescheduling facility was conditional on obtaining NOC from the central bank, provided that the board of directors of the bank concerned is convinced that the client is compliant with a relevant circular and has not defaulted yet.

"The mission understood that important and connected borrowers default, because they can," the IMF noted. The BB did not agree with the observation and termed it not publishable.

The central bank claimed that it effectively supervises the SoBs and monitors loans to the connected borrowers with a few exceptions.

"The BB's on-site supervision applies the same rigour compared to what is applied in case of other types of bank."

Contacted, Ashadul Islam, Senior Secretary of the Financial Institutions Division, said the ministry's version on this report has already been sent to the IMF.

He, however, did not elaborate on this issue.