Discretionary authority of banks on loan write-off is broadened with the volume of elimination of receivable amounts from their balance sheets increased by 150 per cent.

The central bank of Bangladesh relaxed its loan-write-off policy to this effect. The Bangladesh Bank argues that the rule is bent on grounds of higher costs associated with filing formal suits.

From now on, banks can write off up to Tk 500,000, more than double the earlier amount of Tk 200,000, without filing any lawsuit with the Artha Rin Adalat.

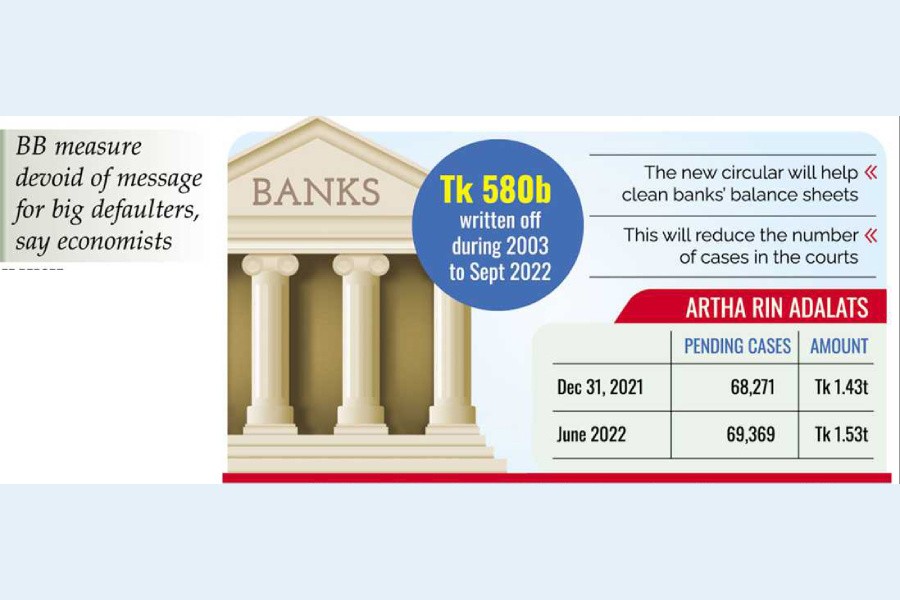

Banks wrote off Tk 580 billion during the period of 2003 to September 2022, according to banking sources.

A circular issued Thursday to this effect by Bank Regulation and Policy Department (BRPD) of the Bangladesh Bank says that Shariah-based Islamic banks can make such arrangements following the circular.

Bankers argue that the policy update is quite okay as they need money and time when they go to court to turn a bad loan into a write-off.

They also say there is an inflationary effect on the economy which justifies the inflated amount, Tk 500,000.

Syed Mahbubur Rahman, managing director and CEO at Mutual Trust Bank (MTB), welcomes the central bank's move. "This is good news for us as we have to incur a loss of huge money for filing cases for such small loans," he told the FE.

He feels that the new measure will help cleanse their balance sheets.

Mr. Rahman, however, thinks that this does not give broad messages for recovery of big default loans banks are burdened with.

"These are marginal loans and marginal clients, usually we can recover it. We should go for big non-performing loans and such message does not carry it."

He says this will reduce the number of cases in the courts concerned, which are reportedly facing a logjam of money cases amid growing loan delinquencies.

Md Shaheen Iqbal, a deputy managing director at BRAC Bank, told the FE that such loans lie with small borrowers, for example, cottage and micro-institutions, and banks cannot recover loans as they cannot be traced.

He said banks need to keep 100-percent provision for making such loan write-off.

Economists say this is just a general forbearance to small borrowers.

"We are not giving the forbearance to the small clients. So it is just general forbearance," says Dr Zahid Hussain, former lead economist at the World Bank Dhaka office.

Dr Hussain also feels that this will not help improve the overall health of the financial sector as it does not have any message for realizing the bad loans from the big defaulters.

Loads of bad loans caught on legal tenterhooks continue to go ballooning, amounting to over Tk 1.5 trillion in recent times.

Bangladesh Bank data obtained until June 2022 show the number of cases pending with Artha Rin Adalats (money loan courts) as 69,369 by then against huge dues, as claimed by banks, amounting to Tk 1.53 trillion.

Earlier, until December 31, 2021, the central bank data had shown the number of cases pending with the money loan courts at 68,271 against the dues claimed by banks at Tk 1.43 trillion.

Of the settled cases of the banks from 2009 to 2019, verdicts on nearly 60 per cent were served against the banks for a lack of legal proficiency and capacity of related bank officials to run the lawsuits, he says.

As of December 2021, after the formation of the money loan court, a total of 207,896 cases were filed with the court against the amount claimed to be over Tk 2.13 trillion.

Of the total cases, 139,625 were settled and Tk 197.03 billion was recovered by different courts across the country as of December 2021, while the amount claimed by the banks was Tk 700.41 billion back then.

After the establishment of the money loan court, the six state-owned commercial banks lodged 82,030 cases with the courts and had funds worth over Tk 1.05 trillion stuck up in the toils of the law.

The specialized banks had filed 36,558 lawsuits involving funds estimated more than Tk 51.72 billion as of December 2021.

The private banks filed 79,418 cases with the courts, involving an amount of over Tk 1.0 trillion as of December 2021.