The stimulus package for the cottage, micro, small and medium enterprises (CMSMEs) has entered into its second phase with amending the target fixation method, officials said.

Under the revised formula, the central bank has fixed the annual target for Tk 200 billion financial package, considering the net outstanding of CMSME loans as on December 31, 2020 instead of gross outstanding of the same calendar year.

The net outstanding has been fixed after deducting the amounts of non-performing loans (NPLs) and interest suspense of the CMSME loans of banks and non-banking financial institutions (NBFIs).

"We've amended the target fixation process for the CMSMEs' package in line with the stakeholders' requirements," a senior official of the Bangladesh Bank (BB) told the FE on Wednesday.

It will help the banks and NBFIs to execute the second phase of the package, the central banker added.

Besides, the central bank had already allowed the banks and NBFIs to provide loans to cottage, micro and small (CMS) enterprises as working capital along with term loans under the package.

"It will also help the lenders implement the package," the central banker said, replying to a query.

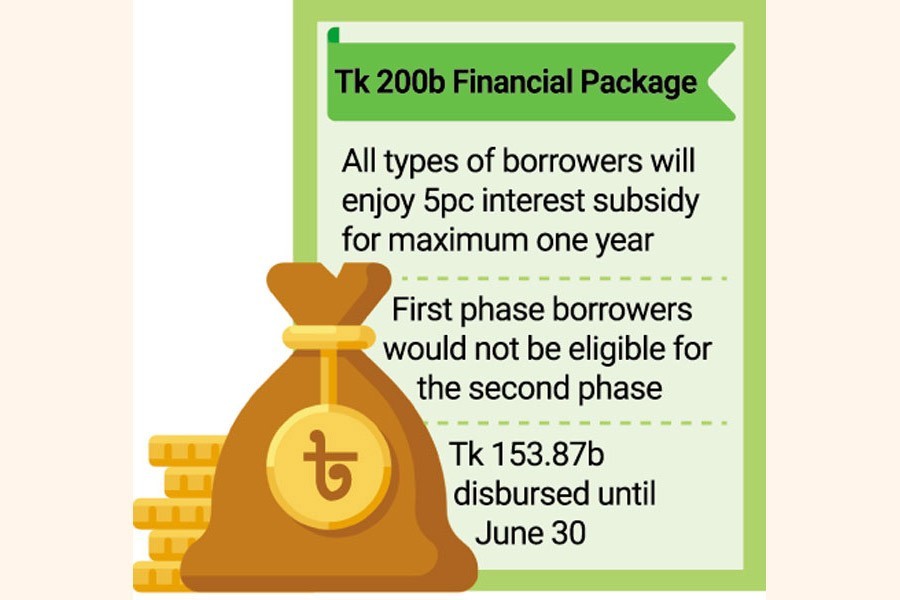

Under the package, all types of borrowers will be entitled to enjoy interest subsidy at 5.00 per cent for a period of maximum one year.

During the period, the borrowers will pay the interest rate at 4.00 per cent out of the 9.0 per cent under the package, while the remaining 5.00 per cent will be paid by the government as interest subsidy to the banks and NBFIs concerned.

The borrowers, who availed assistance from the first phase of the package, would not be eligible for the second phase in line with the BB policy.

But loans of the borrowers will be continued in line with the 'bank-customer' relationship, paying 9.0 per cent interest rate instead of 4.0 per cent earlier, according to another BB official.

In the first phase, the banks and NBFIs disbursed Tk 153.87 billion of the stimulus package until June 30 last, according to the central bank's latest monitoring report on the package.

The disbursed amount was nearly 77 per cent of the total Tk 200 billion fund for the sector.

A total of 97,814 Covid-19-affected CMSMEs across the country benefited through receiving the low-cost loans under the just-concluded first phase of the package.

Meanwhile, the central bank has sent limits to the scheduled banks and NBFIs for execution of the second phase of the stimulus package for CMSMEs to facilitate recovery of the Covid-hit economy.

"We've also asked the banks and NBFIs to submit their branch-wise targeted distribution lists as early as possible," the central banker noted.

He also said it will help strengthen monitoring and supervision for implementation of the package properly.

"We've started the process of implementing the second phase of the stimulus package for CMSMEs fully," Syed Abdul Momen, BRAC Bank's SME Banking Head, told the FE.

He also said BRAC Bank is now working to execute 100 per cent of the target, set by the BB, by March 31, 2022 instead of June 30 in the next calendar year.