The central bank sees a possible broad-based economic recovery in the near future due to improvement in Covid situation and wider reopening.

It, however, warned of lurking downside risks from both internal and external fronts.

In its latest quarterly review of the state of national economy and international causatives the Bangladesh Bank attributed the turnaround largely to the decline in Covid-19 infections alongside vaccination drives for immunization.

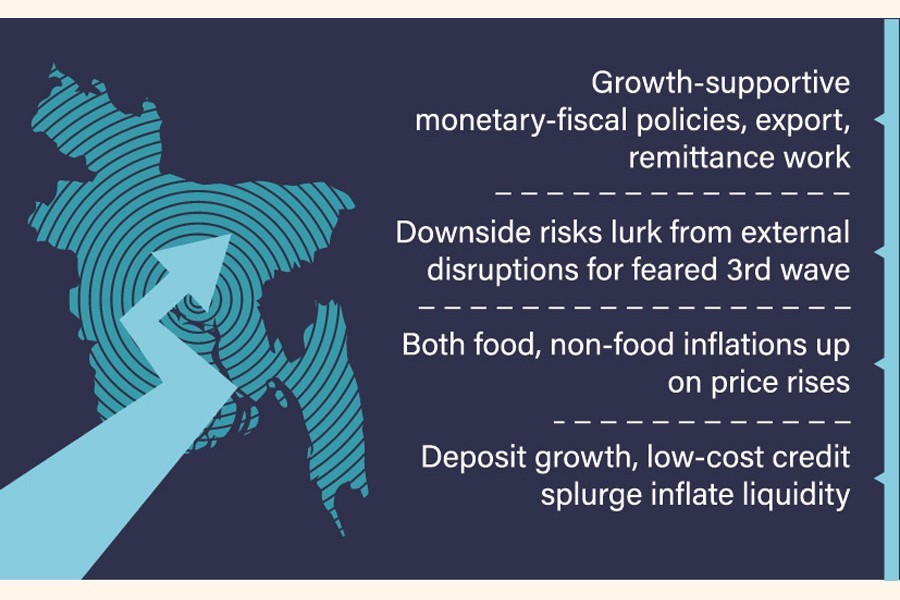

The ongoing growth-supportive fiscal and monetary policies and optimistic outlook of exports are expected to help revamp the Covid-hit economy, according to officials.

"We see the country's overall economy still on right track with some risks," a senior official of the Bangladesh Bank (BB) told the FE Thursday while explaining the latest economic situation of Bangladesh.

On the global front, slower-than-expected growth, rising inflation, shortage of inputs and labour, and rising shipping costs appear to be the downside risks to recovery, says the Bangladesh Bank Quarterly (BBQ) for April-June 2021.

"In addition, some inflationary pressures may build up in the coming quarters because of any unexpected supply-chain disruption on top of the continuation of global price hikes," the BBQ says on a note of caution.

As reaffirmed in the recent monetary policy statement (MPS), the central bank will remain vigilant and take necessary actions to contain any undue inflationary pressure and maintain macro-financial stability.

"Extraordinary coordination among the regulatory authorities of the government would need to be continued for successful implementation of various economic programmes in response to fight against Covid-19," the BBQ noted.

It is expected that the continuation of the supportive monetary-and fiscal-policy measures could help mitigate the pandemic-inflected economic losses and uplift the economy to its normal course in fiscal year (FY) 2021-22.

Talking to the FE, Mustafa K. Mujeri, executive director of the Institute for Inclusive Finance and Development (InM), urged the policymakers to adopt pro-CMSMEs (cottage, micro, small and medium enterprises) policy for brining socioeconomic dynamism in the country's rural areas.

Dr Mujeri, a former chief economist at the BB, also said the coverage of vaccination should be enhanced immediately to fight against the Covid-19 pandemic. "Vaccination is only way to fight against the deadly coronavirus.

Mentioning different supports for less-priority along with informal sectors, Khondaker Golam Moazzem, research director at the Centre for Policy Dialogue (CPD), said the quality of post-Covid recovery in different economic arenas is a challenge.

"We should think about the possible adverse impact of the global challenges on the domestic market," Dr Moazzem said while replying to a query.

Citing example, he also said the profit margins of apparel manufactures have already decreased following higher prices of cotton on the global market.

"The prices of imported food items may increase in the local markets on the same ground," he noted.

The BBQ hopes the lifting of strict countrywide lockdown measures to prevent the rapid transmission of Delta variant of coronavirus since mid-April 2021, and gradual reopening of economic activities in Bangladesh and most of the country's export destinations are likely to help robust growth in remittance inflows and export earnings.

However, the resumption of economic activities may also result in strong import demand in the near term, according to the BBQ.

"Though foreign-exchange reserves are sufficient to cover the potential import payments underpinned by the steady growth in remittance inflows, potential risks to remittance inflows lurk in switching to hundi system," the BBQ noted.

It also says the downside risk to external sector arises from threat of the third wave because of mutations of the virus despite the recent decline in Covid-19 transmission rate and massive government procurement of vaccines from all major suppliers.

"With timely implementation of stimulus package and continued fiscal and extraordinary monetary policy supports, Bangladesh economy started rebounding from the Covid-19 fallout," the central bank explained.

Hefty remittance inflow and low-cost finance propelled the consumption expenditure which helped revitalize the growth momentum, outweighing the supply-side disruptions following the nationwide lockdown and restrictions in the final quarter of FY'21 to limit the spread of Delta variant of Covid-19 pandemic.

Regarding private-sector credit growth, the BBQ says the private credit growth remained subdued in the face of weak investment demand amidst the Covod-19 situation.

"A rise in deposit growth in tandem with low credit growth inflated the liquidity further in the banking system, and both the deposit and lending rates maintained broadly a downward trend during FY '21," it noted.

The central bank also says the banking sector performed well in the outgoing fiscal year amid the Covid-19 pandemic compared to FY'20, supported by prudential banking-resilience policies by the BB.

"Asset quality, capital adequacy, and profitability were much better than expected in FY'21," the BBQ noted about the process of economic reflation from the pandemic-induced deflation.

Despite good performance in FY'21 despite the covid-19 pandemic, the banking sector may face challenges in increasing private-sector credit growth, containing the rising non-performing loans (NPLs) and minimizing credit risk in the near future due to the second wave of the Covid-19 pandemic, and its severity in the coming quarters.

Regarding inflationary pressure on the economy, the central bank says like food inflation, non-food inflation (point-to-point inflation) also remained on its upward trajectory since February 2021 and reached 5.94 per cent in June 2021.

The rise in non-food inflation is mostly attributed to clothing and footwear prices, household furniture, operations and repairing, transport and communications.

Costs of clothing and footwear, and household furniture, operations and repairing increased by 4.59 per cent and 7.17 per cent, on average, respectively, in the months of the final quarter of FY '21, reflecting an upturn in demand, according to the BBQ.

It also says transport and communications expenses remained high as government continued to take restrictive measures in this sector to minimize the spread of coronavirus infections.