Following an upward trend, Bangladesh's external debt declined to some extent in the first quarter (Q1) of the current fiscal year (FY 2022-23) thanks to lower public borrowings due to stalled less-priority projects amid the sluggish economic situation.

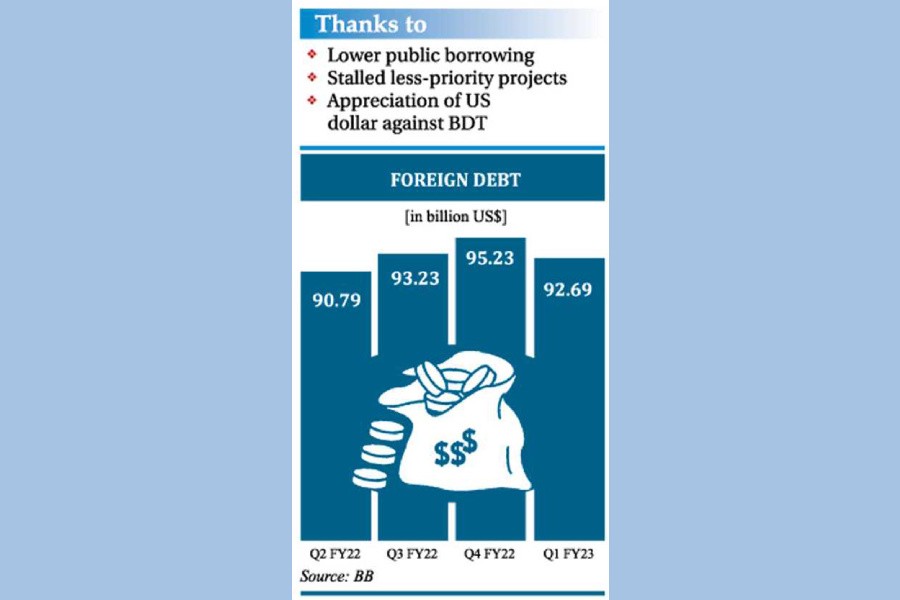

The debt fell by over US$ 2.54 billion to $ 92.69 billion in the July-September quarter of FY 2022-23 from $ 95.23 billion in the previous quarter (April-June period of FY 2021-22), according to latest figures of Bangladesh Bank (BB).

In the January-March and October-December quarters of the last FY, the foreign debt figures - $93.23 billion and $90.79 billion - showed an upward trend.

Of the total Q1 debt, the public sector accounted for $67.29 billion, down $0.73 billion from the previous quarter while private sector debt declined by $0.55 billion to $25.40 billion.

Of the private sector debt, about $11.05 billion was directly borrowed by the power, gas and petroleum sectors, followed by the manufacturing sector $4.22 billion and trade and commerce around $3.0 billion.

Seeking anonymity, a BB official said the public sector draw down from the external sources plummeted by around 25 per cent in the Q1 of the current FY, contributing to the downward trend in the foreign debt situation.

Moreover, many private sector players have repaid their debt on maturity during the period, he added.

When contacted, Managing Director & CEO of Mutual Trust Bank Limited (MTB) Syed Mahbubur Rahman said some development projects were stalled by the government in recent times considering the current economic situation.

So the fund is not disbursed and it might have reflected in the data, he said. "This (the fall) looks good in the short term. If it continues, it will have an impact on the economy."

Research director at local think-tank Centre for Policy Dialogue (CPD) Khondaker Golam Moazzem said the cost of foreign funds keeps going up in recent days because of the appreciation of the greenback.

It may have discouraged the private sector from external borrowing, he said. At the same time, he added, the government de-prioritises some projects considering those expensive under the current circumstances.

"I think it is a positive development in the existing economic scenario as it will help lessen the government's repayment pressures," the economist said.

"If the downward trend continues in the coming days, the country will benefit in the mid-term," he added.